- TOP

- Investor Relations

- Shareholder and share information

- Dividend Policy / Dividend History

Dividend Policy / Dividend History

Dividend Policy

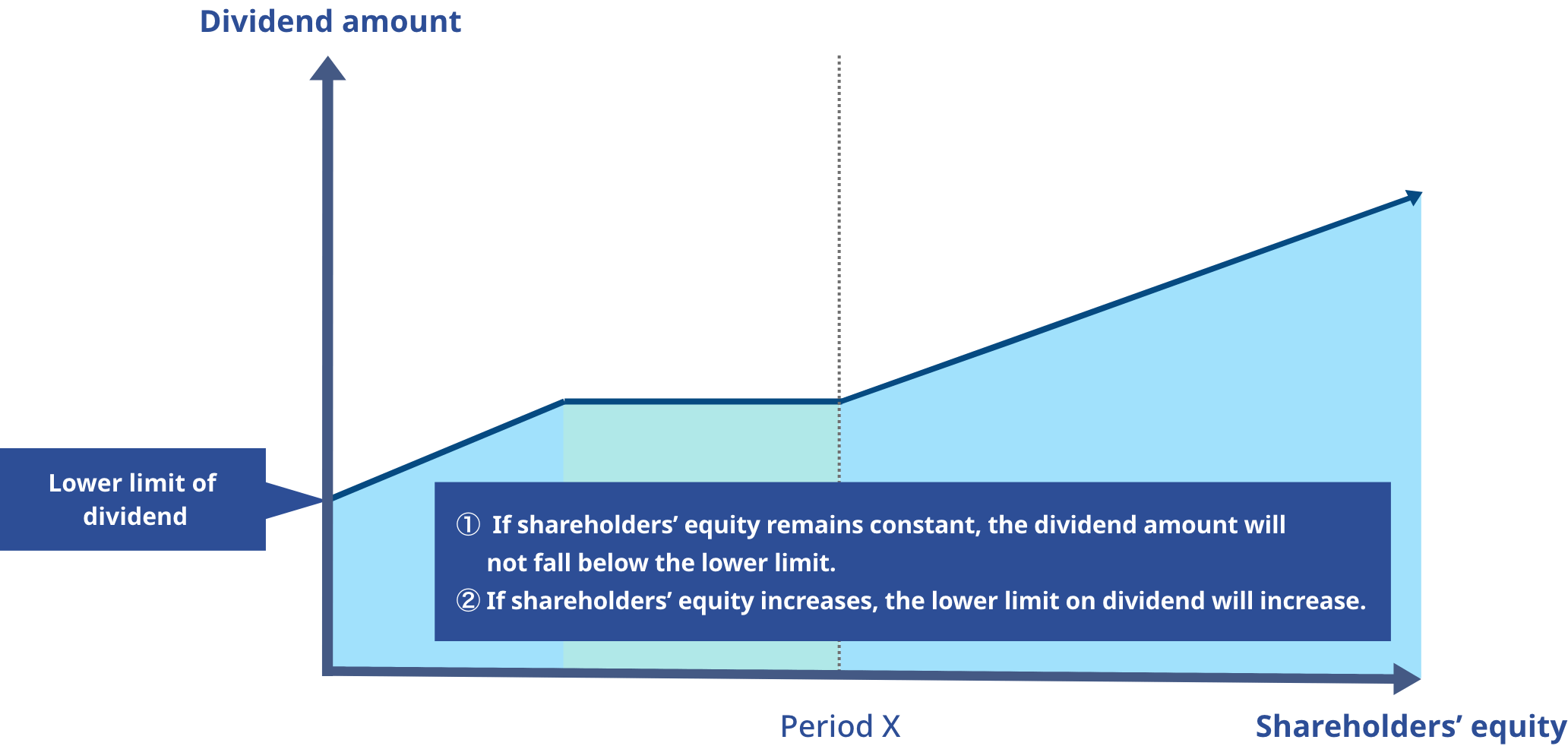

Our basic policy is to continue to pay a stable dividend while securing the necessary internal reserves for future business expansion and strengthening the management structure to improve shareholder value over the medium to long term. Rather than the payout ratio, we focus on a stable dividend in terms of the actual amount, which is why we have adopted DOE* as a new KPI. The reason for this adoption is to show shareholders that, in principle, the dividend amount will not fall below the lower limit if shareholders' equity remains constant, and that if shareholders' equity increases, the minimum dividend amount will increase. In the medium-term management plan (fiscal year ending March 31, 2023, to fiscal year ending March 31, 2025), we aim to achieve a DOE of over 3.0% in the final year.

Dividends on equity=(Annual dividend per share/Equity per share)×100

Significance of Introducing DOE

Dividend History

| Dividend Per Share(Yen) | Total Dividend Payment (Full-year) | Dividend payout ratio | DOE | |||||

|---|---|---|---|---|---|---|---|---|

| 1st Quarter | 2nd Quarter | 3rd Quarter | Term-end | Full-year | (Million Yen) | (%) | (%) | |

| FY3/2024 (Forecast) | - | 27.00 | - | 27.00 | 54.00 | - | - | - |

| FY3/2023 | - | 26.00 | - | 28.00 | 54.00 | 1,625 | 29.6 | 3.0 |

| FY3/2022 | - | 24.00 | - | 28.00 | 52.00 | 1,450 | 18.4 | 3.2 |

| FY3/2021 | - | 21.00 | - | 21.00 | 42.00 | 1,053 | 37.0 | 2.8 |

| FY3/2020 | - | 21.00 | - | 21.00 | 42.00 | 1,068 | 29.3 | 2.9 |

| FY3/2019 | - | 19.00 | - | 20.00 | 39.00 | 1,000 | 25.1 | 3.0 |

Please note the following:

- This site will not be immediately updated if correction of earnings data and others are announced.

- Frequency of updates may vary due to changes in earnings report format.

The data used within this site is compiled from the earnings announcements.

In the preparation of the various data shown within this site, we make every effort to ensure its accuracy. But despite our best efforts, the possibility for inaccuracy in the data due to reasons beyond our control exists.

For more detailed earnings information please see the Reference Material.