- TOP

- Investor Relations

- Medium-term Management Plan

Medium-term Management Plan

Please see the material here for more information.

Overview of the Medium-term Management Plan

Central Goals of the New Medium‐term Management Plan (FY3/24 to FY3/26)

Medium‐term Management Policy “Vision”

- Creating a prosperous society through our businesses

- Creating a resource‐recycling and environment‐conscious society

- Creating new future through the convergence of trading and manufacturing capabilities

- Upgrading of corporate governance

Reinforce the financial structure

- Make current businesses more profitable: More support for companies receiving investments

- Increase efficiency of investments: More post‐merger integration, effective use of corporate venture capital (CVC) ➡ 12%+ ROE and 6%+ ROIC

- Fund procurement efficiency/diversity: Centralized management of group company cash by using a cash management system

Upgrade the human capital

- Strengthen ability to recruit skilled people by using the unique ALCONIX business model and raising awareness of the ALCONIX brand

- Establish a training program to enable employees to acquire skills and reach their full potential

- Make extensive use of transfers of personnel among group companies

Strengthen governance

- Upgrade the functions of the Board of Directors by reexamining the director skill matrix and taking other actions

- Reorganization of the ALCONIX Group (for example, established AC Metals as a preparatory company for the integration of for trading segment)

- Reinforce training for senior management of group companies

Action Plan: Support to Enable Companies Added Through Acquisitions to Increase Corporate Value on Their Own

Fully utilize non‐ferrous metals trading company knowledge and information gathering skills acquired since ALCONIX started operations in 1981

Trading segment (original business/core business) + Manufacturing segment (a growth business)

M&A Strategy and Action Plan

- Continue M&A activity targeting manufacturers in the metal processing category

- Reinforce the commitment to supporting manufacturing in Japan as the business climate changes dramatically

- Return of manufacturing to Japan due to geopolitical risk Solutions for business succession problems

- Start new businesses in the automobile, semiconductor and electronic materials sectors

- Activities that reflect rapid changes in customers’ needs and technological progress

- Use corporate venture capital

- A broader range of targeted business sectors for M&A activity

- Receive flexible investment returns

Performance Targets(FY3/26)

FY3/26: Sales ¥223 Billion, Operating Profit ¥12 Billion, ROE 12%+, EBITDA ¥16 Billion (+¥3.2 Billion)

- Stable foundation for business operations (constant investments to produce benefits after 2 to 3 years)

- Efficiency of investments is a priority (ROE, ROIC)

- Newly designated EBITDA as a KPI to support a consistently large volume of investments

- The DOE*3 is newly used as a KPI for the stability of shareholder distributions with a target of at least 3.2% in FY3/26

| FY3/2022 | FY3/2023 | FY3/2024 | FY3/2026 | ||||

|---|---|---|---|---|---|---|---|

| (Unit: billion yen) | Results | Results | Outlook | YoY change | Outlook | vs. FY3/2023 | |

| Net sales | 152.6 | 178.3 | 177.0 | ▲1.3 | 223.0 | +37.0 | |

| Operating profit | 11.0 | 8.3 | 6.2 | ▲2.1 | 12.2 | +3.8 | |

| Ordinary profit | 11.0 | 8.1 | 6.2 | ▲1.9 | 12.0 | +3.8 | |

| EBITDA | 15.1 | 13.2 | 11.0 | ▲2.2 | 16.0 | +3.2 | |

| ROE*1 | 15.1% | 10.5% | 9.8% | ▲0.7% | 12.0% | - | |

| ROIC*2 | 6.7% | 4.6% | 4.5% | ▲0.1% | 6.3% | - | |

| DOE*3 | 2.9% | 3.0% | 2.9% | ▲0.1% | 3.2% | +0.2% | |

- ROE: Return on equity (profit attributable to parent company shareholders ÷ shareholders' equity x 100)

- ROIC: Return on invested capital (operating profit after tax ÷ (interest-bearing debt + shareholders' equity) x 100) *Deemed effective tax rate is 33%

- DOE: Dividend on equity (annual dividend per share ÷ shareholders' equity per share x 100)

(Definition of “shareholders’ equity”: “capital” + “capital surplus” + “retained earnings” in the consolidated balance sheet)

ESG/SDGs Activities

ESG Activities (Except Governance)

Environment: Focus on issues from the perspective of dealing with non‐ferrous metals, non‐ferrous metals processes and processing equipment

Preparations for Task Force on Climate Related Financial Disclosures (TCFD) compliance, measures for a circular economy (recycling business) and other activities

Society: The priority is human capital strategies

The basic principle is to treat our people as valuable assets in both trading and manufacturing operations

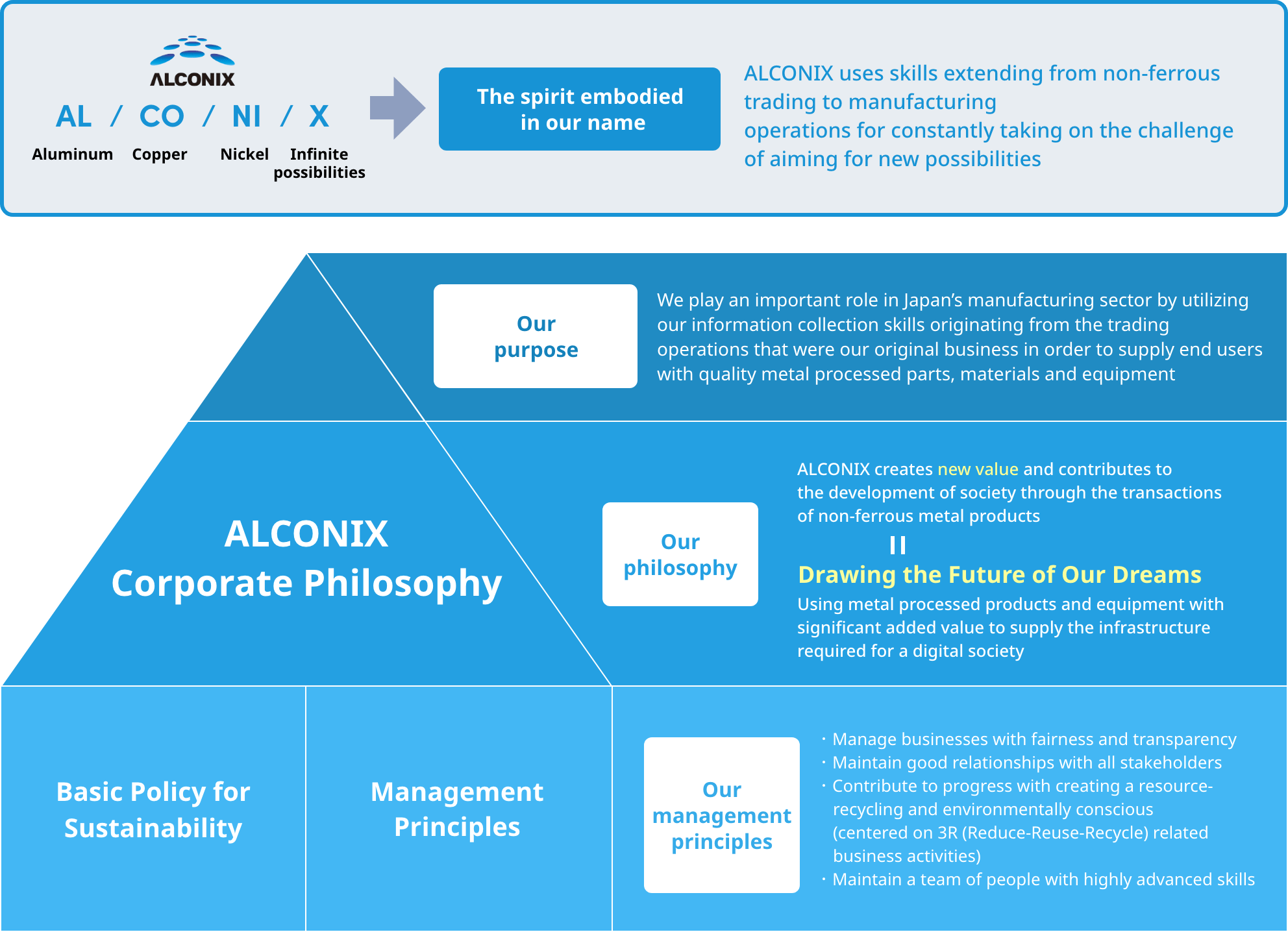

Basic Policy for Sustainability

Base all activities on the guidelines for behavior and the values defined in the ALCONIX corporate philosophy for a sustainable “future of our dreams.”

Our diverse workforce is firmly dedicated to taking actions with all stakeholders for solving environmental, social and governance (ESG) issues.

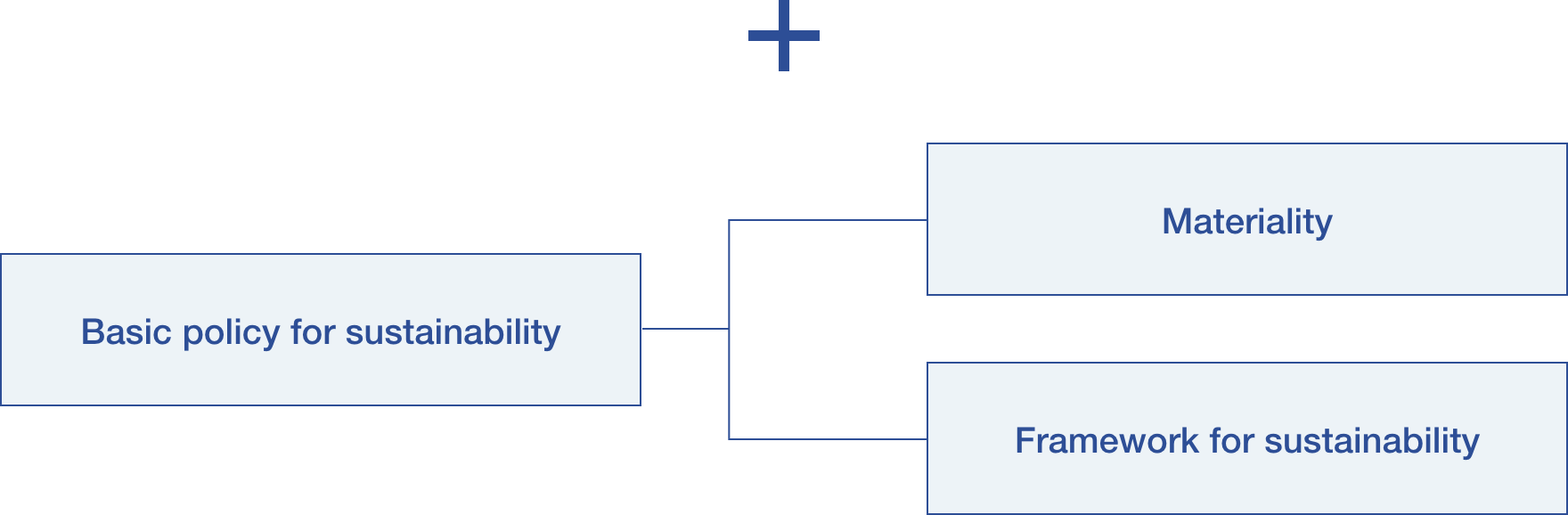

Materiality

Strengthening our human capital is positioned as a fourth materiality

- EEnvironmentally responsible businesses for the reduction of carbon and the reuse of resources

- SBuild stronger ties with stakeholders and take actions that show respect for human rights

- GReinforce internal controls with emphasis on frameworks for compliance and risk management

- HEstablish an assignment and training system that supports the creative activities of a diverse workforce and provide pleasant and productive workplaces

Human capital initiatives

- Reskilling programs for seniors

- Upgrade recruiting capabilities (hire many people, improve salaries and benefits)

- Strengthen training and skill development programs (sustainable management training, many types of

e‐learning)

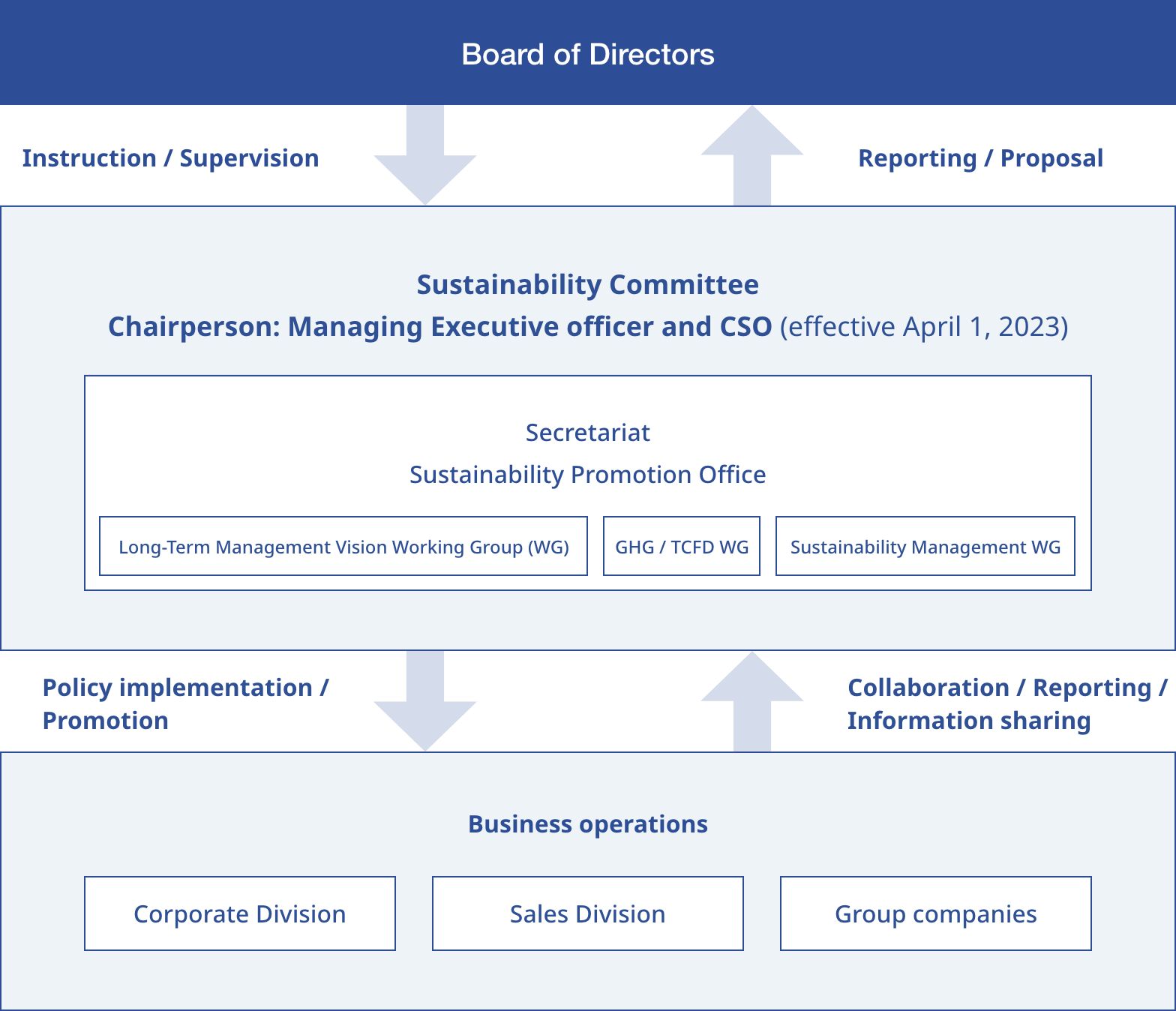

Framework for Sustainability

See below to learn more

This material has been created for a better understanding of the company and is not intended for investment solicitation.

This material has been created carefully for accuracy purposes; however, this does not ensure integrity.

The company shall not be held responsible in any way for loss or damage caused by information within this material.

Earnings forecasts and future predictions within this material have been determined by the company based on available information at the time of creation and include potential risks and uncertainty. Please be advised that, due to changes in the business environment and other various factors, actual results may differ from the future prospects mentioned or described.