- TOP

- Sustainability

- Environment

Environment

Environmental Policy

The ALCONIX Group has positioned the promotion of environ-mentally friendly business as one of its material issues, and recognizes that climate change will have a significant impact on achieving this goal in terms of formulating strategies and making business decisions. To address this, in fiscal 2023 we endorsed the recommendations put forth by the Task Force on Climate-related Financial Disclosures (TCFD). Going forward, we will continue to maintain a good understanding of the effects of climate change and any related initiatives on our business activities and of the financial impact of any counter measures, and contribute to environmental and social sustainability through appropriate disclosure and relevant initiatives. Furthermore, to ensure the Group’s sustainable growth and increase its corporate value, we will actively use the disclosed information to engage in dialogue with stakeholders.

ALCONIX positions global environmental issues as one of its key management mandates, and reflects this awareness in all of its activities. It strongly endeavors to contribute to the conservation and improvement of the global environment to pass a healthy and rich Earth on to future generations. The following are the key principles that define its environmental policy:

ALCONIX's Environmental Policy

-

Reduction of our burden on the environment

We contribute to the resolution of environmental issues such as global warming, ozone layer depletion, air pollution, water pollution, soil contamination, noise pollution, vibration, and noxious odors.

-

Promotion of business models focused on recycling and low energy consumption

ALCONIX helps solve environmental issues by reusing and recycling resources currently threatened by depletion and by promoting the use of materials and products that contribute to the reduction of energy use.

-

Compliance with all environmental laws and regulations

ALCONIX complies with all applicable environmental laws, regulations, and ordinances. In addition, we fulfill all environmental commitments resulting from any agreements or arrangements we have previously chosen to accept.

-

Enhancement of environment management processes and procedures

We remain committed to establishing and maintaining environmental management processes and procedures while also striving to continuously improve our environmental management systems. Meanwhile, we will conduct educational and awareness-raising activities to ensure that all employees are deeply aware of global environmental issues before proceeding with corporate activities. Through efforts such as these, we will further enhance the impact of our global environmental preservation activities.

Initiatives Related to Climate Change

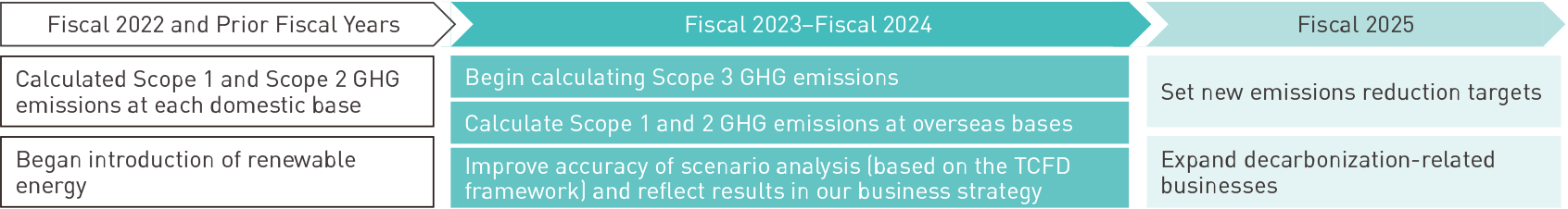

Our Climate Change Road Map

The Group is working to address climate change in line with the road map laid out in Medium-Term Management Plan 2023. Here, we will focus on our progress up to the first half of fiscal 2024.

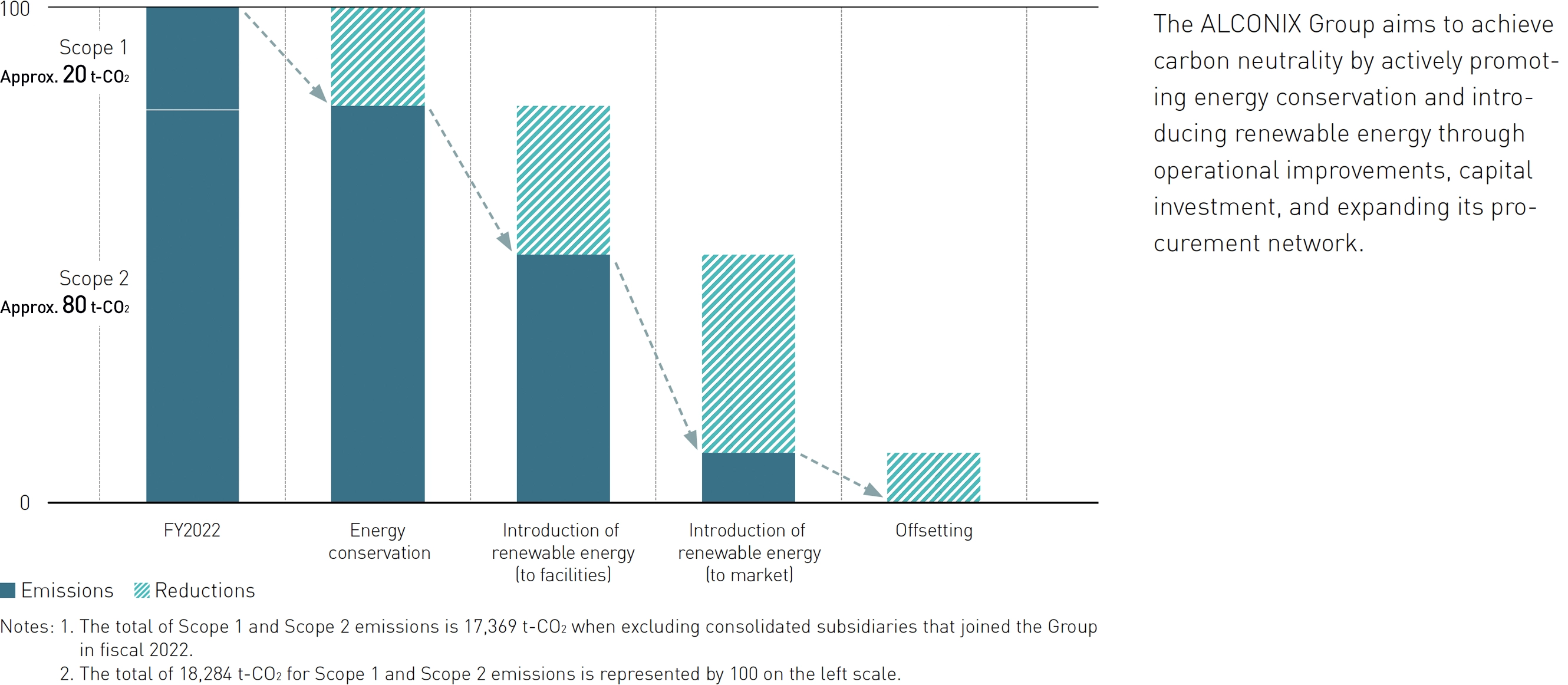

Efforts to Reduce Greenhouse Gas Emissions

After conducting an analysis of the Group’s greenhouse gas emissions, we found that electricity use comprises approximately 80% of the ALCONIX Group’s total emissions within Japan.

In light of these results, the ALCONIX Group is moving forward with efforts that will help create a carbon-neutral society. These efforts include switching to renewable energy sources for all offices and factories, cutting back on fossil fuel use by improving efficiency of production, and using carbon offsets to balance out residual emissions.

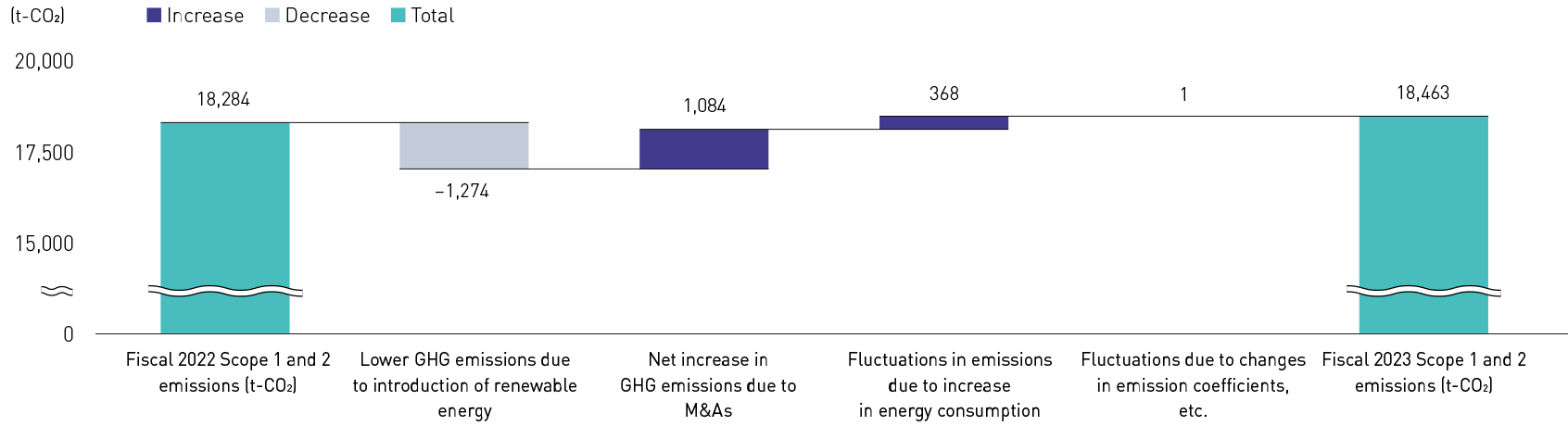

One-Year GHG Emissions (Scope 1 and Scope 2 for All Consolidated Domestic Bases)

GHG Emissions by Segment for All Consolidated Domestic Bases

| Indicators | Business Segment | Fiscal 2021 | Fiscal 2022 | Fiscal 2023 |

|---|---|---|---|---|

| GHG emissions: Scope 1 and Scope 2 |

||||

| Trading | 832t-CO2 | 623t-CO2 | 816t-CO2* | |

| Manufacturing | 15,734t-CO2 | 17,660t-CO2 | 17,647t-CO2* | |

| Groupwide | 16,568t-CO2 | 18,284t-CO2 | 18,463t-CO2* |

* Figures differ from those stated in the Securities Report for fiscal 2023, which was disclosed on June 20, 2024, due to a more detailed examination of emissions.

Please refer to our corporate website for examples of business activities aimed at achieving the Sustainable Development Goals (SDGs).

Developmental Initiatives in Line with TCFD Recommendations

In recognition of the strong impact climate change bears upon the ALCONIX Group’s business, we have positioned climate change as a priority issue for management, analyzed its potential risks and opportunities, and developed countermeasures accordingly.

In line with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD), we performed a scenario analysis in fiscal 2021 and fully endorsed the recommendations in fiscal 2023. Although our initial scenario analysis focused on the dealings of the Head Office, we will broaden the scope of this analysis and gain a better understanding of our environmental impact going forward. To this end, we will newly include relevant departments in our discussion and analysis to ensure greater measurement accuracy and to elicit the appropriate countermeasures.

Greenhouse Gases and TCFD Working Group

Targets of Investigation

Business Scope:

The Group’s three key sectors, with the intentionof gradually expanding to all of theGroup’s businesses, which include ALCONIXCORPORATION, overseas businesses, andsubsidiaries

Information Disclosure and Issues:

Disclosure is organized into 11 items in fourcategories, in line with TCFD recommendations.Under this framework, we will refine ourfinancial impact assessments andcountermeasures.

Participation in Initiatives

The survey for fiscal 2024 dealt with climate change. After submitting the survey, we received a score of “B”(Management level) based on our responses. We will continue to respond to the survey in future years and put forth efforts to improve upon this score.

An NGO that requires participating companies to disclose environmental information on behalf of institutional investors and purchasing companies worldwide. The CDP’s disclosure system is the international standard for environmental disclosure

Our Response to CDP Climate Change 2024 Questionnaire

(in Japanese)

Disclosure in Line with TCFD Recommendations

In recognition of the strong potential impact of climate change upon the ALCONIX Group, a group with global operations, we have positioned climate change as a priority issue under sustainability management. In today’s international society, conditions are becoming increasingly diverse and complex, and this includes escalating social and environmental issues, one of which is climate change. We believe that giving these issues the attention they deserve and conducting proactive corporate activities as a resolute response will not only help resolve these issues but also prompt the Group’s growth.

Accordingly, in 2003, we defined our Environmental Policy as our basic philosophy underpinning environmental conservation efforts, and in May 2022, we formulated our Basic Policy for Sustainability and identified our material issues (materiality), providing a foundation for improving medium- to long-term corporate value befitting a company listed on the Prime Market segment of the Tokyo Stock Exchange. In regard to TCFD recommendations, we conducted a scenario analysis in fiscal 2021 and fully endorsed the recommendations in fiscal 2023. We are currently disclosing information in line with the recommendations, and we will continue to provide details regarding the financial impact of climate change and our response going forward.

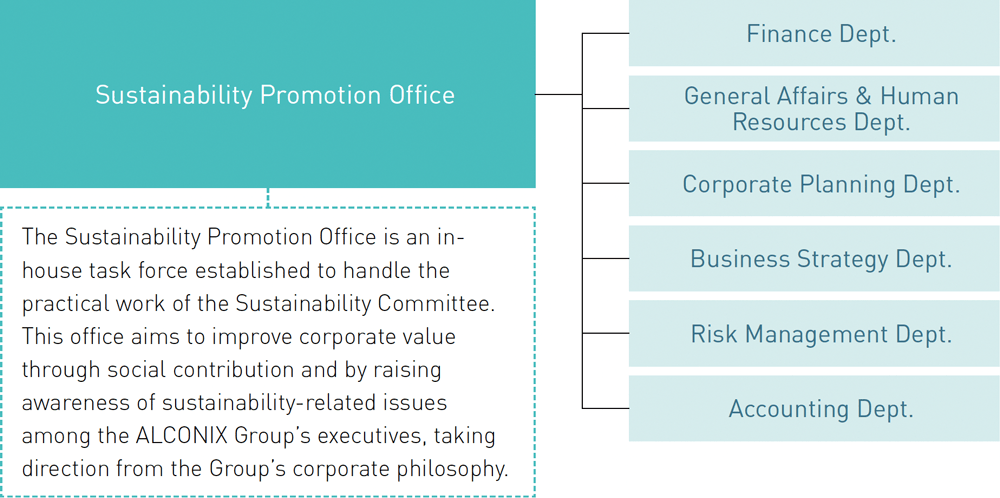

Governance

a) Framework for Monitoring Climate-Related Risks and Opportunities

The Board of Directors serves as the highest decision-making body, overseeing policies related to sustainability, including climate change. The General Manager of the Corporate Division, who is also a member of the Board, holds the position of Executive Managing Officer and Chief Strategic Officer (CSO). This officer is responsible for practical matters concerning climate change. Additionally, the CSO chairs the Sustainability Committee, where discussions on the company’s sustainability policies, including those addressing climate change, are conducted.

b) Management’s Role in Assessing and Managing Climate-Related Risks and Opportunities

In recognition of the significant impact that climate change and other ESG issues have on the ALCONIX Group’s business, we have prioritized them as key management concerns. We have analyzed the potential risks and opportunities associated with these issues and developed appropriate countermeasures.

In December 2021, we established the Sustainability Committee, and in May 2022, we formulated the Basic Policy for Sustainability. The Sustainability Committee consists of six members: five internal directors and one full-time auditor serving as an observer. The committee is chaired by the Executive Managing Officer and CSO. Meetings are held at least once every quarter, and the outcomes of discussions are reported to the Board of Directors as necessary. The Sustainability Promotion Office, subordinate to this committee, is mainly responsible for the formulation of various policies and the resolution of ESG-related issues.

Risk Management

a) Process by Which Organizations Identify and Assess Risks

In recognition of potential risks, we ensure the responsible departments take proactive measures to minimize them. In addition, cross-functional committees, such as the Risk Management Committee, the Internal Control Committee, and the Sustainability Committee, implement measures to manage risks. For risks related to sustainability, the Sustainability Promotion Office takes the lead in identifying risks and evaluating their potential impacts.

b) Process by Which Organizations Manage Climate-Related Risks

As a general rule, the Sustainability Promotion Office is in charge of formulating climate change risk response plans. The Sustainability Committee reports risk identification, assessment, and countermeasures to the Board of Directors for approval.

c) Position of Climate Change-Related Risks

The Company’s overall risk management is handled by the Risk Management Committee, with the Risk Management Department serving as its secretariat. With regard to risk identification and assessment, any risk considered to have a major potential impact on business is considered to be a serious risk. This designation is assigned based on the results of risk assessments conducted by ALCONIX CORPORATION, branch offices, and Group companies, taking into account social conditions and related physical risks such as disasters. Currently, the Risk Management Committee does not hold discussions regarding climate-related risks; however, in the future, it will work with the Sustainability Committee to conduct comprehensive investigations and discussions of climate-related risks, treating them as serious risks.

Strategy

a) Process for Identifying Short-, Medium-, and Long-Term Climate-Related Risks and Opportunities

Investigation Status of Short-, Medium-, and Long-Term Risks and Opportunities

The Sustainability Promotion Office related departments, and affiliated companies will discuss risks and opportunities pertaining to climate-related issues to remain consistent with the timeline of Medium-Term Management Plan 2023, announced in May 2023.

Process for Identifying Risks and Opportunities with a Significant Financial Impact on the Organization

When conducting a scenario analysis, the Sustainability Promotion Office with the support of relevant departments within the Head Office, identify serious climate change-related risks and opportunities, assess their impact, and investigate possible countermeasures.

In the future, we will expand the scope of our scenario analysis beyond the three key sectors that comprise the majority of our business while also increasing accuracy.

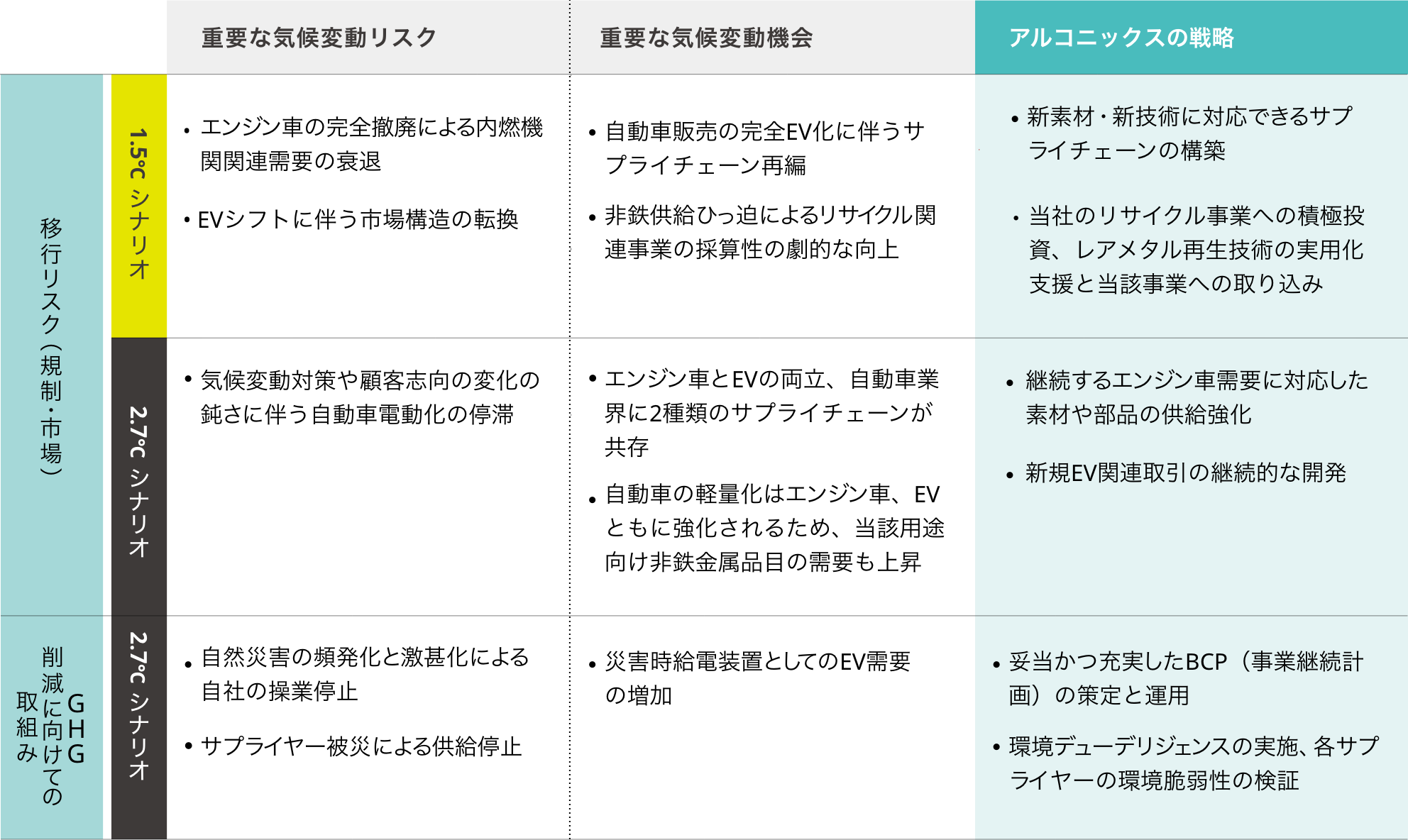

b) Impact of Climate-Related Risks and Opportunities on Business, Strategic, and Financial Plans

c) Resilience of Strategies after Considering Multiple Climate-Related Scenarios

Representatives from the aforementioned relevant departments took part when considering business opportunities in fiscal 2022. Our scenario analysis, which focused on transactions within our three key sectors, confirmed the growth potential and resilience of our business.

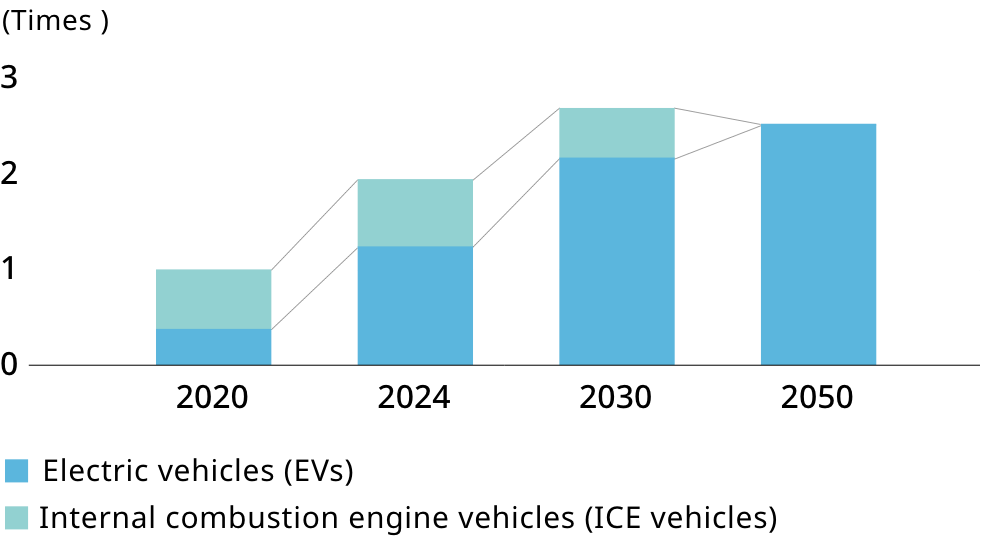

The TCFD framework

Climate change is an unclear phenomenon that is difficult to predict, so to identify the opportunities and risks related to climate change and how they are relevant to the Group, we conducted a scenario analysis based on the TCFD framework for automobile-related transactions, which is a key domain. Going forward, we will also conduct scenario analysis in other key domains and confirm risks and opportunities for the Group.

Analysis of effects of climate change

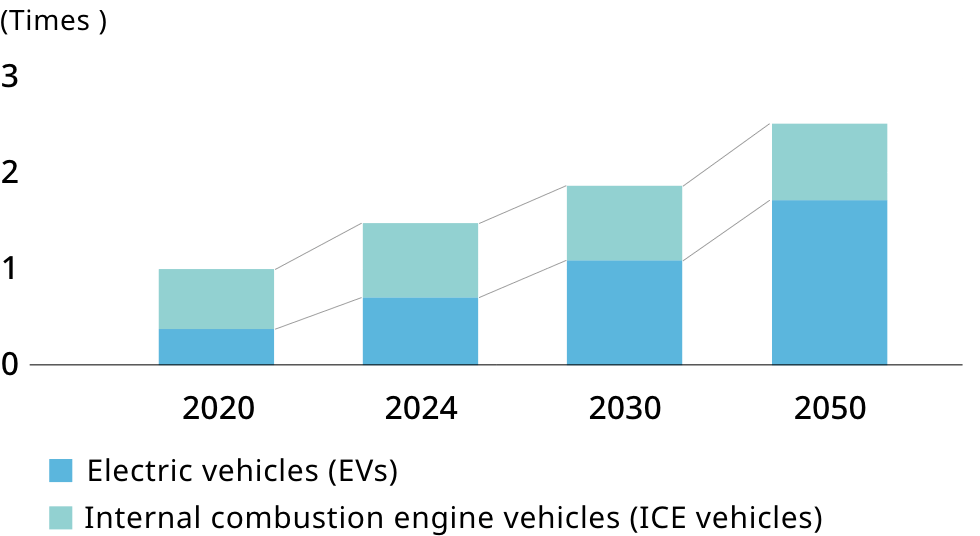

Scenario analysis of automotive transactions in the key automobile sector based on the TCFD framework For both scenarios, this analysis demonstrated that the increasing use of EVs will probably almost double the volume of automotive business at the ALCONIX Group between 2020 and 2030

Scenario analysis

Automotive transactions at ALCONIX (40%+ of non-consolidated business volume) Analysis of transactions involving electric vehicles (EVs) and internal combustion engine vehicles (ICE)

Scenarios used

IEA “Net Zero by 2050 Scenario” “Stated Policies Scenario”

The Net Zero by 2050 Scenario assumes that net greenhouse gas emissions will fall to zero in 2050 (avg. temperature increases only 1.5℃)

The Stated Policies Scenario assumes that current environmental policies of countries worldwide will remain unchanged (avg. temperature increases 2.7℃)

Results of analysis

1.5℃ Scenario

- ICE Vehicles transaction volume down approximately 90% by 2050

- EVs transaction volume up by approximately six times

Transaction Volume Forecast (2020 = 1)

2.7℃ Scenario

- ICE Vehicles transaction volume up approximately 1.4 times by 2050

- EVs transaction volume up by approximately 4.5 times

Transaction Volume Forecast (2020 = 1)

Details Regarding the TCFD Scenario Analysis

The next steps

- Increase the scenario analysis to cover the entire ALCONIX Group

- Implement strategies for risks and opportunities identified by the scenario analysis

- Consider analysis of scenarios for markets other than EVs

Indicators and Targets

a) Indicators Used to Assess Climate-Related Risks and Opportunities

Our management strategy is heavily weighted toward M&As, and as such, this approach could potentially lead to erratic increases in greenhouse gas emissions produced by the Group.

Therefore, the possibility of additional relevant KPIs that will aid us in increasing our corporate value and reducing effective greenhouse gas emissions are currently under consideration, such as the introduction rate of renewable energy, the investment amount for energy-saving equipment, and net sales for businesses that contribute to decarbonization.

b) Scope 1, 2, and 3 Greenhouse Gas Emissions

Began calculating Scope 3 GHG emissions

From the start of fiscal 2024, we began calculating Scope 3 emissions for ALCONIX and its domestic consolidated subsidiaries (as well as their consolidated subsidiaries). Calculations were weighted heavily toward Scope 3 emissions under Category 1, purchased goods and services, which are relatively higher than other categories owing to the Group’s Trading segment. Moreover, the scope of calculations in fiscal 2024 will be limited to domestic bases, but in subsequent years, we plan to broaden the scope of calculations to include overseas bases and to expand the categories covered by calculations.

| Category | Fiscal 2023 (t-CO2) |

Calculation Method, Emission Intensity, etc. | Target |

|---|---|---|---|

| 1. Purchased Goods and Services |

1,042,601 | Calculated by multiplying the purchase price or purchase amount of purchased products by the emission intensity coefficient from the Ministry of the Environment database*1 | 21 companies, covering the Company, its domestic consolidated subsidiaries, and their consolidated subsidiaries |

| 2. Capital Goods | 9,875 | Calculated by multiplying the acquisition cost of non-current assets by the emission intensity coefficient from the Ministry of the Environment database | As above |

| 3. Fuel- and Energy-Related Activities Not Included in Scope 1 or Scope 2 | 2,779 | Calculated by multiplying the amount of electricity and steam purchased by the emission intensity coefficient from the Ministry of the Environment database and the amount of fuel purchased by the emission intensity coefficient from the LCI database**2 | As above |

*1 Ministry of the Environment database: Emission Factor Database on Accounting for Greenhouse Gas Emissions Throughout the Supply Chain (Ver. 3.4), released by the Ministry of the Environment

*2 LCI database: IDEA Version 3.1, released by the IDEA Lab, part of the Research Institute of Science for Safety and Sustainability for the National Institute of Advanced Industrial Science and Technology

Note: We are currently establishing calculation methods for Category 4 and beyond; therefore results for these categories have not been included for fiscal 2023.

Began calculating Scope 1 and 2 GHG emissions at overseas bases

Up to the end of fiscal 2023, we only calculated Scope 1 and Scope 2 emissions for domestic bases owned by the Company and its domestic consolidated subsidiaries (as well as their consolidated subsidiaries). However, from fiscal 2024 onward we will utilize the know-how we have acquired to expand the calculation of these emissions to cover our overseas bases.

| Fiscal 2023 (t-CO2) | Scope1 | Scope2 | Total |

|---|---|---|---|

| Overseas bases | 2,539 | 16,754 | 19,293 |

| All Consolidated Group | 6,570 | 31,186 | 37,756 |

Note: Includes results for 31 consolidated overseas subsidiaries and their respective subsidiaries

Improved accuracy of scenario analysis (based on the TCFD framework) to reflect in management strategy

The TCFD/GHG Working Group, under the umbrella of the Sustainability Committee, is in the process of selecting suitable scenario analysis methods and target businesses to analyze, taking into consideration the Group’s business structure and available data.

As we work to formulate our next medium-term management plan, which is scheduled to be disclosed in May 2025, we will be looking into GHG reduction targets and plans.

c) Targets Used to Manage Climate-Related Risks and Opportunities, and Performance in Meeting Targets

As an initial step toward addressing climate change, the ALCONIX Group began calculating its greenhouse gas (GHG) emissions in fiscal 2021. Until fiscal 2023, we only calculated Scope 1 and Scope 2 emissions for the Company and its domestic consolidated subsidiaries (as well as their consolidated subsidiaries). However, from fiscal 2024 onward we will calculate Scope 1 and Scope 2 emissions for our overseas bases and Scope 3 emis sions for our domestic bases to better assess the status of emissions throughout our entire supply chain.

In the future, we will expand the scope of calculations further and begin developing reduction targets and plans.

Breakdown of Efforts Toward Achieving Carbon Neutrality(100 = ALCONIX domestic consolidated emissions)

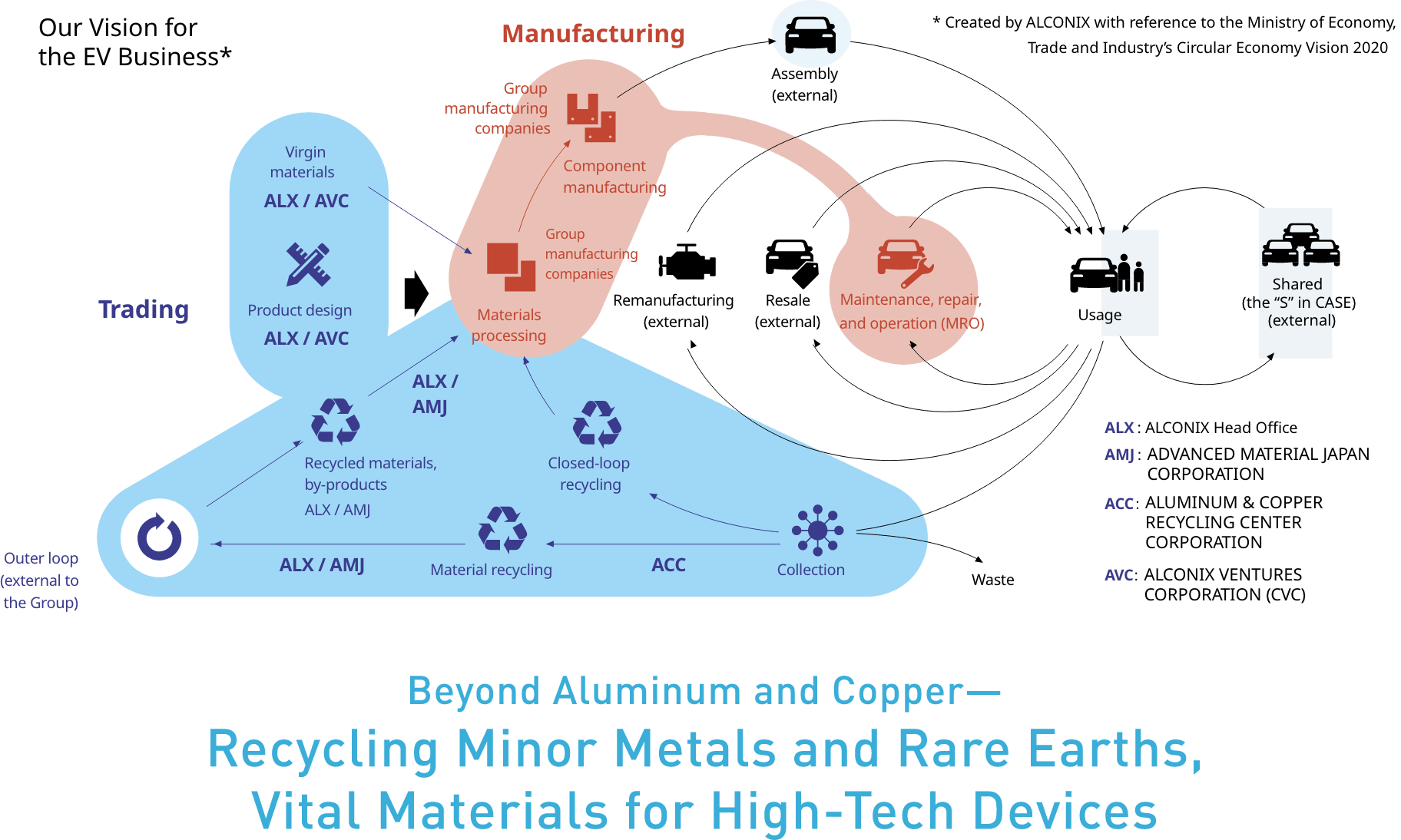

Contribution to the Achievement of a Recycling-Oriented Society

Our main products, aluminum and copper, are both familiar and indispensable components of people's daily lives. In recent years, they have also become increasingly important as lightweight materials essential for improving the fuel efficiency of automobiles and facilitating the shift toward electric vehicles. As a designer that anticipates the emergence of new industries while remaining committed to developing new businesses and establishing a strong presence, ALCONIX recognizes the vital importance of providing stable supplies of both aluminum and copper. At the same time, we view reducing the environmental impact of our refining processes as one of our core responsibilities and as an effective means of contributing to society.

ALCONIX’s Commitment to Aluminum and Copper Recycling

We have a certain responsibility as a group that handles aluminum and copper, two valuable natural resources. To fulfill this responsibility, we are actively involved in activities to recycle and make more efficient use of these resources. Aluminum and copper are both crucial for reducing automobile weight, which helps reduce their environmental impact, and are also necessary for producing semiconductors and electronic material parts and products, which are growing in demand.

Aluminum in particular will be an important material for a variety of purposes owing to its strong and lightweight nature. On the other hand, Japan, which largely depends on the import of these materials from abroad, is experiencing a problem securing a stable supply of aluminum and copper to meet its demand, due to environmental and resource protection efforts that have resulted in a drop in the volume of aluminum and copper mined with each passing year, as well as a decline in the quality of ore. The solution to this problem, which is turning heads, is the reuse of aluminum and copper scrap.

Contributing to Society through Recycling

Melting and recycling metal scrap produces approximately 1/30 of the CO2 emissions compared to the process of extracting and refining new metals from mineral bauxite, thus greatly reducing environmental load. We also sell the fuel used in the recycling process as recycled heavy oil, which contributes to the sustain able use of resources both in terms of reducing CO2 emissions and reducing waste. Another development in recent years has been the use of recycled materials in delivery boxes. We recognize that this will reduce transportation costs and CO2 emissions generated by redelivery, and will be a very significant and indispensable initiative for the coming era.

ALCONIX’s Vision for the Future

The need to recycle non-ferrous metals, a depletable resource, is expected to grow as decarbonization and the implementation of IoT-based technologies become more prevalent. This need will be especially important in Japan, which imports a large portion of its resources. Accordingly, as it aims to jointly generate both social and economic value, ALCONIX has resolved to establish a sustainable supply of non-ferrous metals by leveraging the knowledge and experience it has accumulated through non-ferrous metal recycling operations it has undertaken and developed since its founding. Specifically, the ALCONIX Group will aim to achieve a "closed recycling system" through which resources are recycled internally. To build this system, we will establish an integrated process that spans from the production of non-ferrous metal materials and components to their wholesale and eventual recovery through recycling operations. As we aim to construct this system, we will step up "complementary investment," through which we expand relevant capabilities by conducting M&A and capital investment, and incorporate new technologies via the application of our CVC fund. By further expanding the scope of our resource recycling operations, we will facilitate the construction of a recycling-oriented economy that benefits society at large.

Achieving Our Vision with a Sustainable and Comprehensive Resource Supply Network for the Group