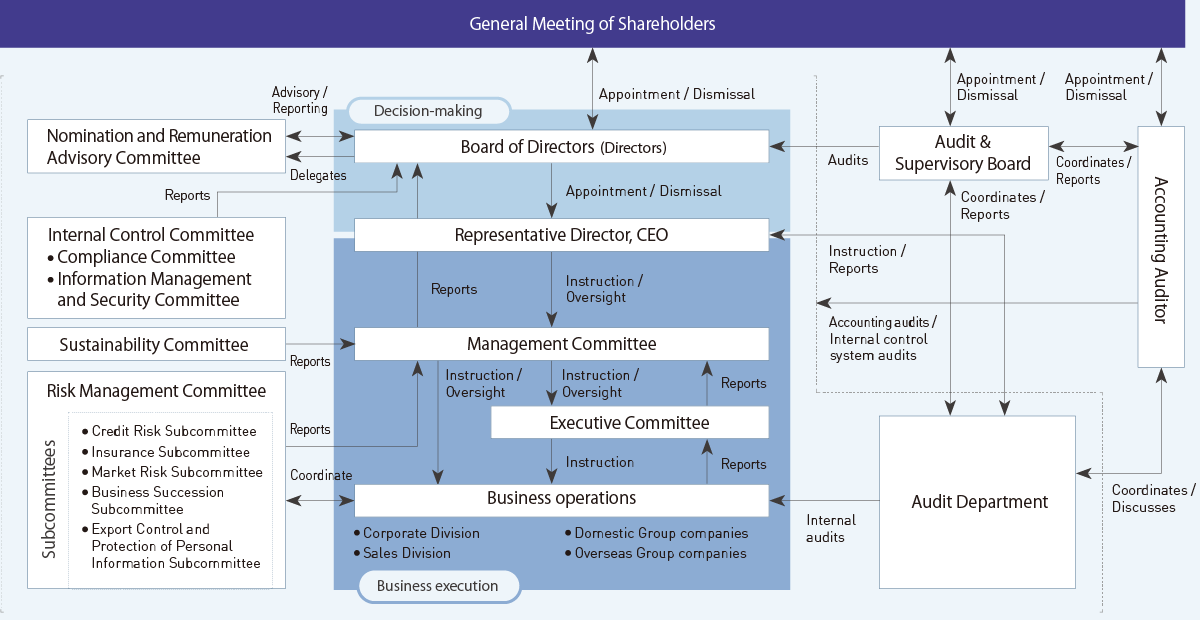

Corporate Governance Structure

- Corporate Governance Structure

- Internal control & Audit systems

- Compliance

- Risk management

Basic Approach to Corporate Governance

ALCONIX recognizes the medium- to long-term enhancement of corporate value as its most important management issue and makes efforts to strengthen its management structure.

Initiatives for Strengthening Governance

With regard to governance, ALCONIX recognizes the need to enhance the Group’s internal audit system, reestablish and thoroughly enforce management regulations and other company rules, improve compliance training, and improve the ALCONIX corporate culture. To this end, we are focused on the following initiatives.

- Point-01Strengthen Internal Control

- Appointment of a Managing Executive in Charge of Internal Control; Strengthening of Internal Control Groupwide

With the increase in companies joining the Group through M&As, we appointed a managing executive in charge of internal control (concurrently serving as the CHRO) in 2021 from the perspective of strengthening internal control throughout the Group. The CHRO works closely with the Audit & Supervisory Board and Audit Department and continues to develop and implement the Group’s internal control systems.

- Point-02Increase Board Effectivenss

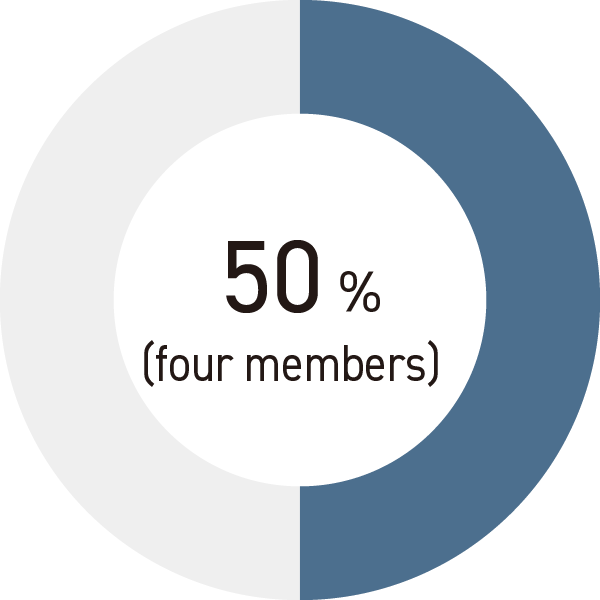

- Strengthening of Our Supervisory Function with a Board of Directors Comprising One-Half Outside Directors

Independent outside directors account for one-half of the Board of Directors. In addition, we strive for diversity within the Board of Directors by making sure it is composed of people with different backgrounds and abilities. This ensures that the Board of Directors is equipped with the expertise and experience that the Group needs.

Message from Outside Directors

I was appointed to ALCONIX's Board of Directors in June 2019, and over this time I have witnessed the hard work and dedicated support of the Board Secretariat and improvements to Board operations, and can sense an increase in the Board’s effectiveness. I attribute this to ALCONIX’s efforts to incorporate the opinions and suggestions of outside officers—who possess a wealth of knowledge and experience in compliance, sustainability, and other matters—into company management. One significant event last year was our transfer to the Tokyo Stock Exchange Prime Market. At that time, the Company faced the unprecedented task of developing and disclosing a governance report that addressed all of the principles in Japan’s Corporate Governance Code (which was revised in 2021) as well as those of the Prime Market. The efforts of the ALCONIX team impressed me greatly, and I believe they will greatly benefit management going forward. Since its establishment, ALCONIX has made a series of acquisitions and is now a group of over 50 companies, with subsidiaries in Japan and overseas. In the future, expansion of the Group through M&A will remain the core of our growth strategy. At the same time, creating synergies between these companies and enhancing Group governance will become increasingly important priorities. As an outside director, I will work to help ALCONIX put in place even better corporate governance systems and develop Group management.

Outside Director

Chairman of the Nomination and

Remuneration Advisory Committee

Masao Hisada

Composition of the Board of Directors

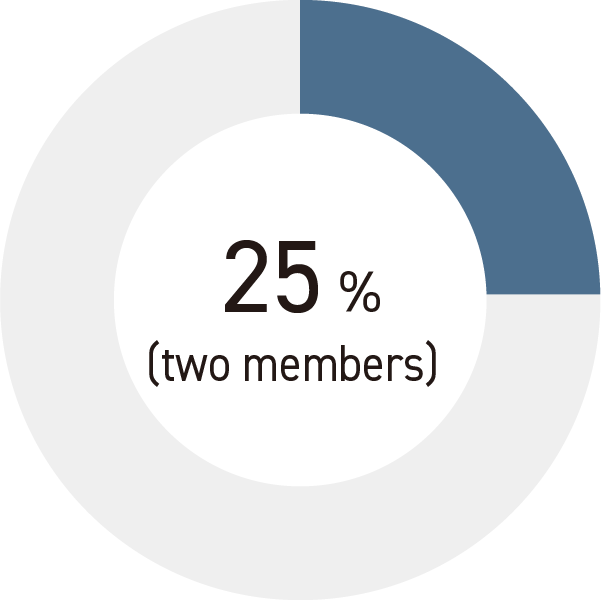

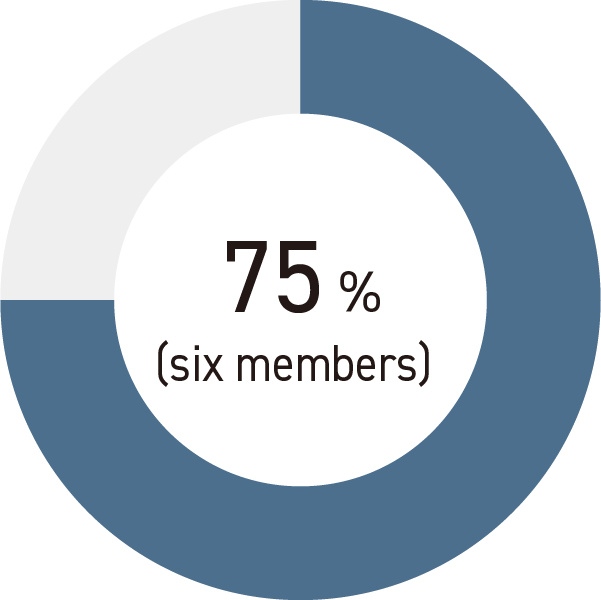

Ratio of outside officers

Ratio of female officers

Ratio of Directors with

International Business Experience

Corporate Governance Overview (As of June 20, 2024)

- Institutional Design

- Company with Audit & Supervisory Board

- Directors

- Eight (including four outside directors)

- Chairperson of the Board of Directors

- President

- Auditors

- Three (including two outside auditors)

- Directors' term of office under the Articles of Incorporation

- One year

- Adoption of Executive Officer System

- Yes

- Directors’ Voluntary Advisory Body

- Nomination and Remuneration Advisory Committee

- [External]Accounting Auditor

- Ernst & Young ShinNihon LLC

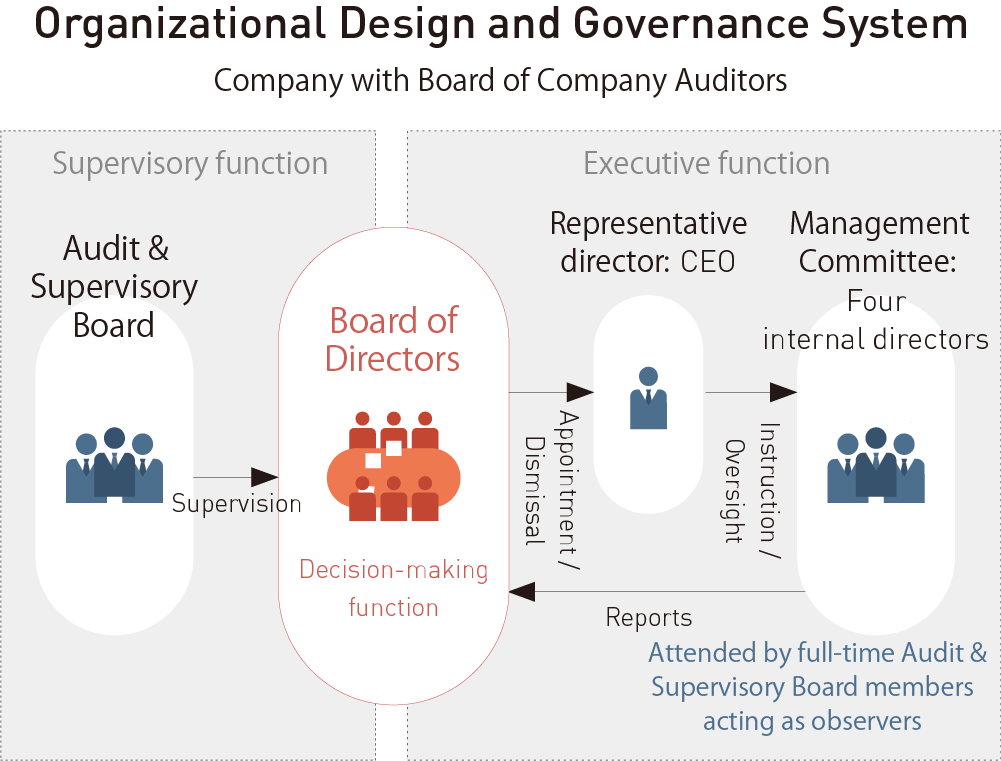

Structure and Institutional Design

ALCONIX appoints multiple outside directors with extensive experience and deep, wide-ranging insight who can provide opinions that contribute to management from objective and broad perspectives. At Board of Directors’ meetings, these opinions provide management with objective perspectives independent of management team business execution. We believe these outside perspectives enable prompt, appropriate decision-making. Further, as a Company with an Audit & Supervisory Board, we appoint several highly independent outside directors with specialized knowledge in legal affairs, accounting, and business to conduct transparent and appropriate supervision and monitoring of the Board of Directors.

Organizational Design and Governance System

The Company emphasizes prompt decision-making in order to implement M&As and investments in a flexible manner. With this focus on decision-making in mind, the Board of Directors has opted for a Company with an Audit & Supervisory Board organizational design. We believe that the appointment of outside directors who can advise management from an objective and comprehensive standpoint and who have a wealth of experience and broad and deep insight enables accurate and prompt decision-making that incorporates external perspectives. In addition, to ensure the independence of its supervisory function, the Company has appointed outside Audit & Supervisory Board members with expertise in law, accounting, and business, who supervise and monitor the Board of Directors in a transparent and appropriate manner.

Board of Directors

The Board of Directors, comprising eight members (four of whom are outside directors), makes management decisions (management policies and plans, the appointment and dismissal of senior management, and other important business execution decisions) based on thorough discussions at regular monthly meetings and extraordinary meetings held as necessary.

Attendance at Board of Directors Meetings in FY2023: 100%

| Moderator | Hiroshi Teshirogi (Representatve Director, President and CEO) |

|---|---|

| Composition |

Eight directors (four outside directors) Note: Three Audit & Supervisory Board members (including two outside members) attend meetings as observers. |

| Meetings held in fiscal 2023 | 13 |

| Main Roles and Authorities |

Note: The execution of business operations that do not require decisions by the Board of Directors is delegated to executive officers and other senior management members in accordance with internal regulations. |

Audit & Supervisory Board

The Audit & Supervisory Board, comprising three Audit & Supervisory Board members (two of whom are outside Audit & Supervisory Board members), meets regularly once a month, with extraordinary meetings held as necessary. The Audit & Supervisory Board deliberates on reports from each Audit & Supervisory Board member and forms audit opinions. The Audit & Supervisory Board also liaises with the Internal Control Department, the Audit Department, auditors at Group companies, and the Accounting Auditor to exchange opinions and share information when necessary.

Audit & Supervisory Board meeting attendance in FY2023: 100%

| Chairperson |

Junichi Kitagaki(full-time) |

|---|---|

| Composition | Internal Audit & Supervisory Board members: One member (full-time) Outside Audit & Supervisory Board members: Two members |

| Meetings held in fiscal 2023 | 14 |

| Main role and authority |

|

Nomination and Remuneration Advisory Committee

The Nomination and Remuneration Advisory Committee is an advisory body to the Board of Directors composed of two outside officers (with one outside director appointed as chairman) and one full-time internal director. The committee deliberates on matters that include succession plans for the chief executive officer; the nomination of directors, executive officers, and other management positions involving business execution; and remuneration.

Nomination and Remuneration Advisory Committee meeting attendance in FY2023: 100%

| Chairperson | Masao Hisada (Outside Director) |

|---|---|

| Composition | Internal directors: One member (full-time) Outside officers: Two members |

| Meetings held in fiscal 2023 | 11 |

| Main role and authority |

|

Decision-Making Body in Business Execution

Management Committee

The Management Committee meets once a month, attended by four internal directors and one full-time Audit & Supervisory Board member as an observer, to conduct advance deliberations on important matters related to business execution, capital policy, corporate organization, strategic risks, and other matters requiring resolutions or reports by the Board of Directors.

Executive Committee

The Executive Committee consists of four internal directors, all four of whom concurrently serve as executive officers, seven other executive officers, the general manager of the Nagoya branch, and one full-time Audit & Supervisory Board member who participates as an observer.

Executive Division Committees (As of June 30, 2024)

| Committee name | Chair and frequency of meetings | Specific role |

|---|---|---|

| Risk Management Committee | Chair: General Manager of the Corporate Division Frequency of meetings: 12 times a year |

|

| Internal Control Committee | Chair: President and CEO Frequency of meetings: 4 times a year |

|

|

Compliance Committee |

Chair: Director in charge of internal control Frequency of meetings: 3 times a year |

|

|

Information Management |

Chair: President and CEO Frequency of meetings: 4 times a year |

|

| Sustainability Committee | Chair: Senior Managing Executive Officer and CSO Frequency of meetings: 4 times a year |

|

Evaluation of the Effectiveness of the Board of Directors

Evaluation of the Effectiveness of the Board of Directors

Once a year, we conduct a survey of all directors and Audit & Supervisory Board members who are members of the Board of Directors to identify issues related to the effectiveness of the Board of Directors, which are then evaluated and analyzed. The evaluation of the effectiveness of the Board of Directors for fiscal 2024 confirms that the composition and operating procedures of the Board of Directors are appropriate. Some issues included the content of deliberations and support systems that are currently in place.

The evaluations were generally positive and confirmed that there was active discussion and deliberation taking place at meetings. Therefore, the Board of Directors has been deemed effective in its role.

Issues identified in the fiscal 2022 Board of Directors’ effectiveness evaluation survey and progress of efforts to resolve them

Main topics covered in the fiscal 2023 survey

- Composition of the Board of Directors

- Matters deliberated at Board meetings

- The Board’s monitoring function

- The provision of training opportunities for Board members and Audit & Supervisory Board members

- Officers’ individual efforts

Issues identified based on the results of the fiscal 2022 survey to be addressed in fiscal 2023

Agenda and Discussion Items for Board of Directors Meetings in Fiscal 2023

| Category | Main items of discussion |

|---|---|

| Overall Management |

|

| Matters Related to Internal Control and Corporate Governance |

|

| Sustainability |

|

| Investment Activities |

|

| Others |

|

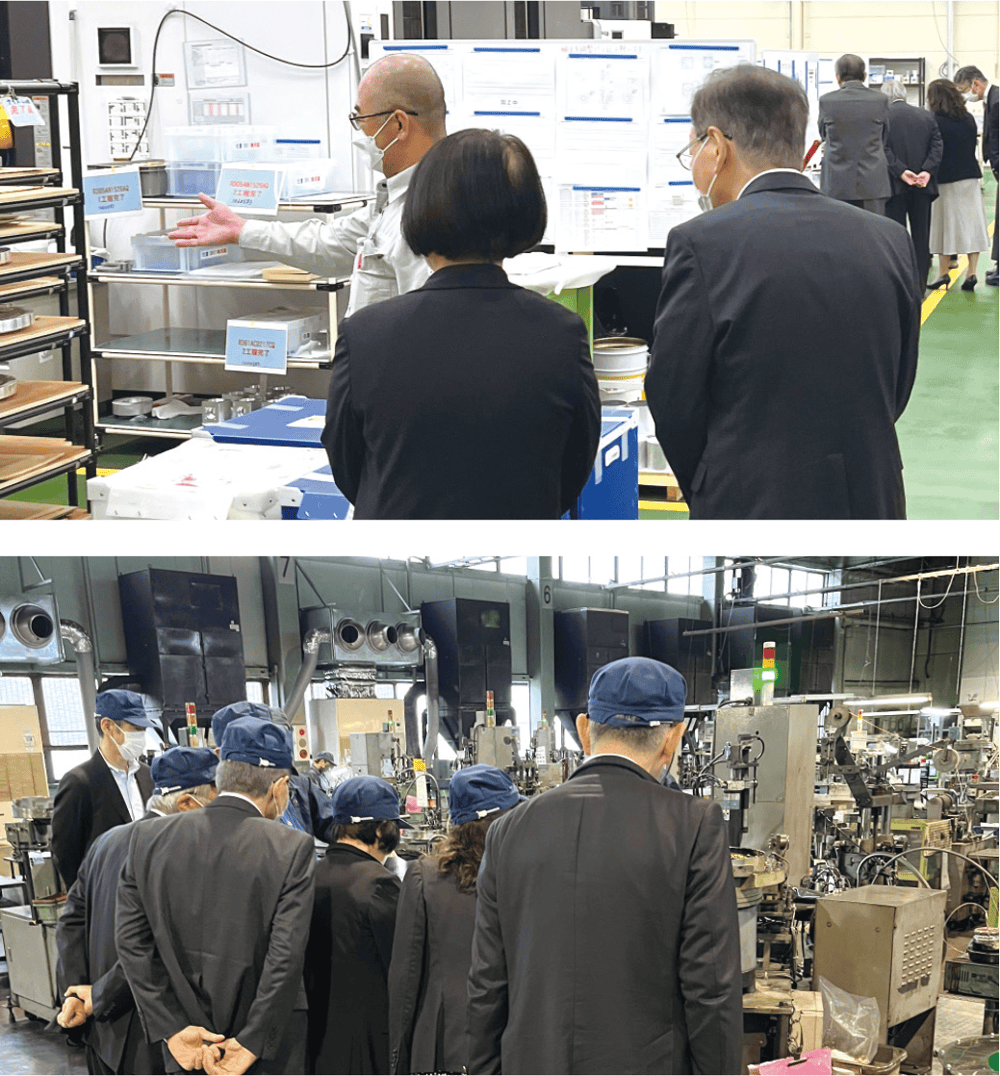

Supporting Outside Officers to Stimulate Discussions at Board Meetings

Visits to Group Companies by Outside Officers

Since fiscal 2020, outside officers (outside directors and outside Audit & Supervisory Board members) have been conducting regular on-site visits to Group companies. The visits are aimed at stimulating discussions at Board meetings and strengthening the Board of Directors’ upervisory function by promoting operational understanding among outside officers. The officers are given a tour of the manufacturing subsidiary’s factory, after which they attend a question-and-answer session held by the president and representatives of the Group company. Social gatherings are also held with frontline employees to ensure good communication with Group personnel.

We have received comments from outside officers that these visits have made it easier to understand product details and manufacturing processes brought up at Board meetings. Since fiscal 2022, we have also held business introductions led by our Head Office’s Corporate and Sales divisions to promote a better understanding of our operations as a whole. We will continue to strengthen our support system for outside officers with a view to realizing an effective corporate governance system.

Appointment and Dismissal of Directors

Appointment and Dismissal of Directors

In line with the selection criteria for candidates for the Board of Directors, internal candidates must have a wide range of knowledge and a wealth of experience related to ALCONIX business management, while outside candidates must meet Tokyo Stock Exchange requirements for independent officers and possess practical, objective perspectives and deep insight that meet the criteria for determining independence as defined by ALCONIX. Regarding the appointment and dismissal of directors and the nomination of director candidates, the Nomination and Remuneration Advisory Committee makes an overall evaluation of candidates with the potential for executing duties appropriately as a director who satisfy requirements in terms of the knowledge, experience, capabilities, and accomplishments required for each position, with recommendations forwarded to the Board of Directors for resolution.

Officer Remuneration System

Officer Remuneration System

The Company's basic policy regarding executive compensation and the amount of compensation for individual officers are determined by the resolution of the Board of Directors, after these matters have been deliberated by the Nominating and Compensation Committee established as an advisory body to the Board to ensure their objectivity and transparency. The Committee takes into consideration as much as possible the business environment outlook for the Group and the latest thinking regarding corporate governance codes in Japan in deliberating the policies and evaluation criteria below.

Basic Principles for Remuneration (Excluding Outside Directors)

Remuneration as a Means to Support Sustainable Value Creation for the Group

-

1) Remuneration is set at a level that provides a healthy degree of motivation to promote sustainable growth and corporate value creation over the medium to long term.

-

2) Performance-linked remuneration is granted fairly and equitably and is determined via a uantitative evaluation based on financial performance, and a qualitative evaluation based on the recipient’s efforts to address issues in accordance with the Company’s medium- to long-term strategy, the extent of decision-making regarding the appropriate allocation of management resources from a medium- to long-term perspective, and the extent of decision-making regarding investments (M&As, capital investments, etc.) based on appropriate risk-taking. This method ensures that the Group’s management is aware of their responsibility for the operating results for each fiscal year.

-

3) Continuous long-term incentives linked to medium- to longterm performance of the Group are granted with the goal of creating sustainable corporate value.

-

4) The Group promotes long-term stock ownership while such remuneration serves to ensure that its recipient, i.e., a director, maintains a shared interest with other shareholders.

Ensuring Objective and Transparent Remuneration Decisions

-

1) The policy for determining remuneration, as well as amounts paid to individual directors is deliberated upon by the Nomination and Remuneration Advisory Committee, of which the majority is outside officers.

-

2) We ensure that remuneration is set at an appropriate level by referencing survey data from external research organizations, making objective verifications, such as comparing levels with other companies in the same industry or of the same size, and taking into consideration the characteristics of the Group’s business.

Remuneration System

Remuneration for directors (excluding outside directors) comprises fixed remuneration and performance-linked remuneration, which is provided as monetary remuneration, performance-linked stock remuneration, in which Company stock is provided in light of sustainable creation of corporate value, and restricted stock remuneration, which is aimed at maintaining a sense of shared value with shareholders through the continued holding of Company stock.

-

1) Composition of Fixed Remuneration

- Supervisor salary

- Fixed remuneration is granted, taking into account a director’s supervisory function (uniform for all) and the degree of responsibility placed upon representatives (representative directors only).

- Executive salary

- Fixed remuneration is granted according to a director’s position (payment for executive duties) plus fixed remuneration according to the role that C-suite executives play in business execution, when applicable.

-

2) Composition of Performance-Linked Remuneration

In addition to fixed remuneration, performance-linked remuneration is granted as a percentage of the executive salary granted for executive duties, ranging from 0–100%.

The amount for each director is determined by the degree to which the Group achieved its consolidated ordinary profit, Total Shareholder Return(TSR) and ROE targets for the fiscal year, both of which are key indicators from a management perspective, and by qualitative contributions by the individual director. This method clarifies responsibility toward operating results for each fiscal year. -

3) Composition of Stock-Based Remuneration

Board Benefit Trust (BBT): 16%

Restricted stock remuneration (RS): 8%

Total Remuneration Amount for Each Officer Classification, Total Remuneration Amount by Type, and Number of Applicable Officers(Fiscal 2023)

| Officer classification |

Total remuneration amount (million yen) |

Total remuneration amount by type (million yen) |

Number of applicable officers |

||

|---|---|---|---|---|---|

| Fixed remuneration | Performance-linked remuneration | Non-monetary remuneration | |||

| Directors (excluding outside directors) |

281 | 214 | 41 | 25 | 5 |

| Audit & Supervisory Board members (excluding outside members) |

24 | 24 | − | − | 2 |

| Outside officers | 80 | 80 | − | − | 7 |

Note: The amount paid to directors includes the remuneration for executive officers who also serve as directors.

Basic Policy for Determining Remuneration for Outside Directors

Remuneration for outside directors performing their supervisory function independent of business execution is limited to fixed remuneration (supervisor salary).

This amount is set after comparison with companies in the same industry or of the same size as ALCONIX. The Nomination and Remuneration Advisory Committee deliberates over the remuneration amount for outside directors and then drafts a proposal for a total amount within the limit approved at the Ordinary General Meeting of Shareholders. This proposal is submitted to the Board of Directors for approval. (As a general rule, remuneration of outside directors does not change, regardless of the number of years they have served. However, the chair of the Nomination and Remuneration Advisory Committee and its members receive a separate payment for committee membership.)

Cross-shareholding Policy

Cross-shareholding Policy

The ALCONIX cross-shareholding policy aims to facilitate business relationships and strengthen corporate alliances. Cross shareholdings account for 4.9% of total consolidated assets (5.4% including unlisted shares), the details of which are provided in the Corporate Governance Status section of the annual Securities Report. Regarding ALCONIX cross-shareholdings, we examine performance, financial conditions, and business transactions of each investee company to determine whether it is appropriate to continue holding company shares, whether the benefits of holding company shares are commensurate with the cost of capital and other important management indicators, and whether strengthening business relationships with suppliers and customers will contribute to ALCONIX sustainable growth and the medium- to long-term enhancement of corporate value. After thorough reviews are conducted by the Risk Management Committee and the Management Committee, the Board of Directors determines the rationale behind continued cross-shareholdings, and if the significance of these holdings declines, the Board’s policy is to engage the counterparty in dialogue and reduce the number of shares held or otherwise dispose of said shares. In exercising cross-shareholding voting rights, the Board of Directors examines all proposal details, scrutinizes whether they are in line with enhancing the corporate value of the investee company, and votes for or against each proposal, as appropriate.