- TOP

- Sustainability

- The ALCONIX Group’s Value Creation Process

The ALCONIX Group’s Value Creation Process

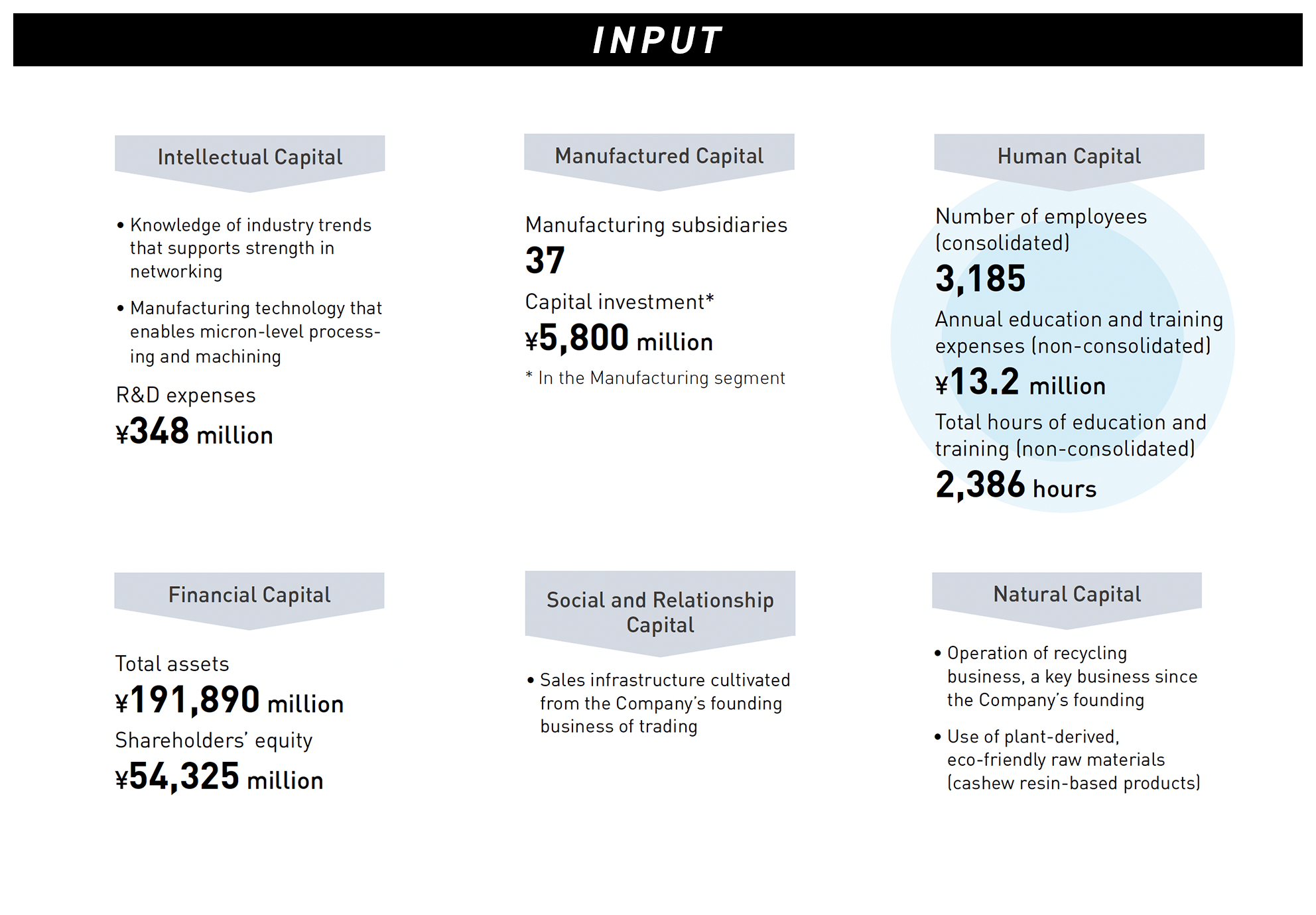

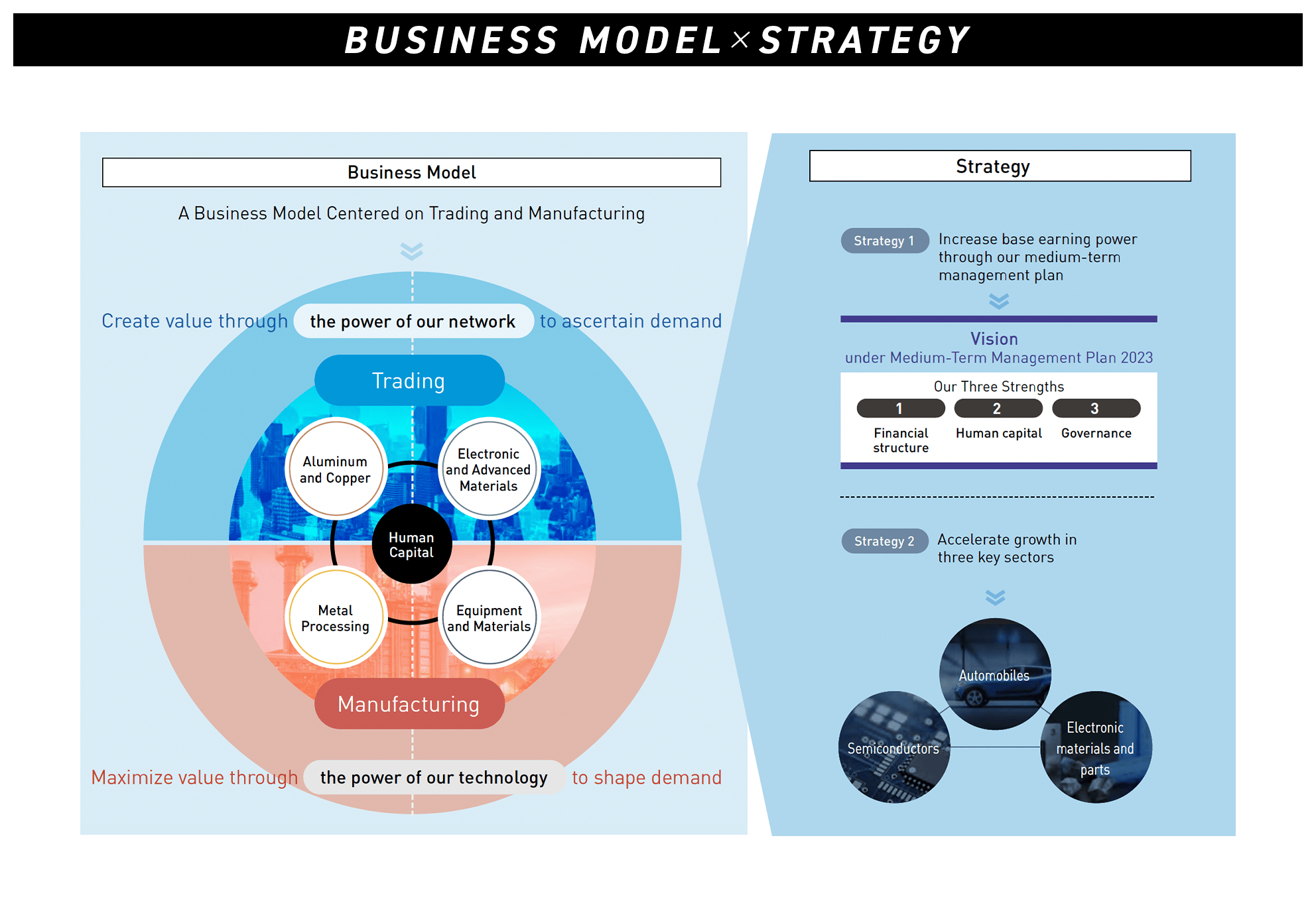

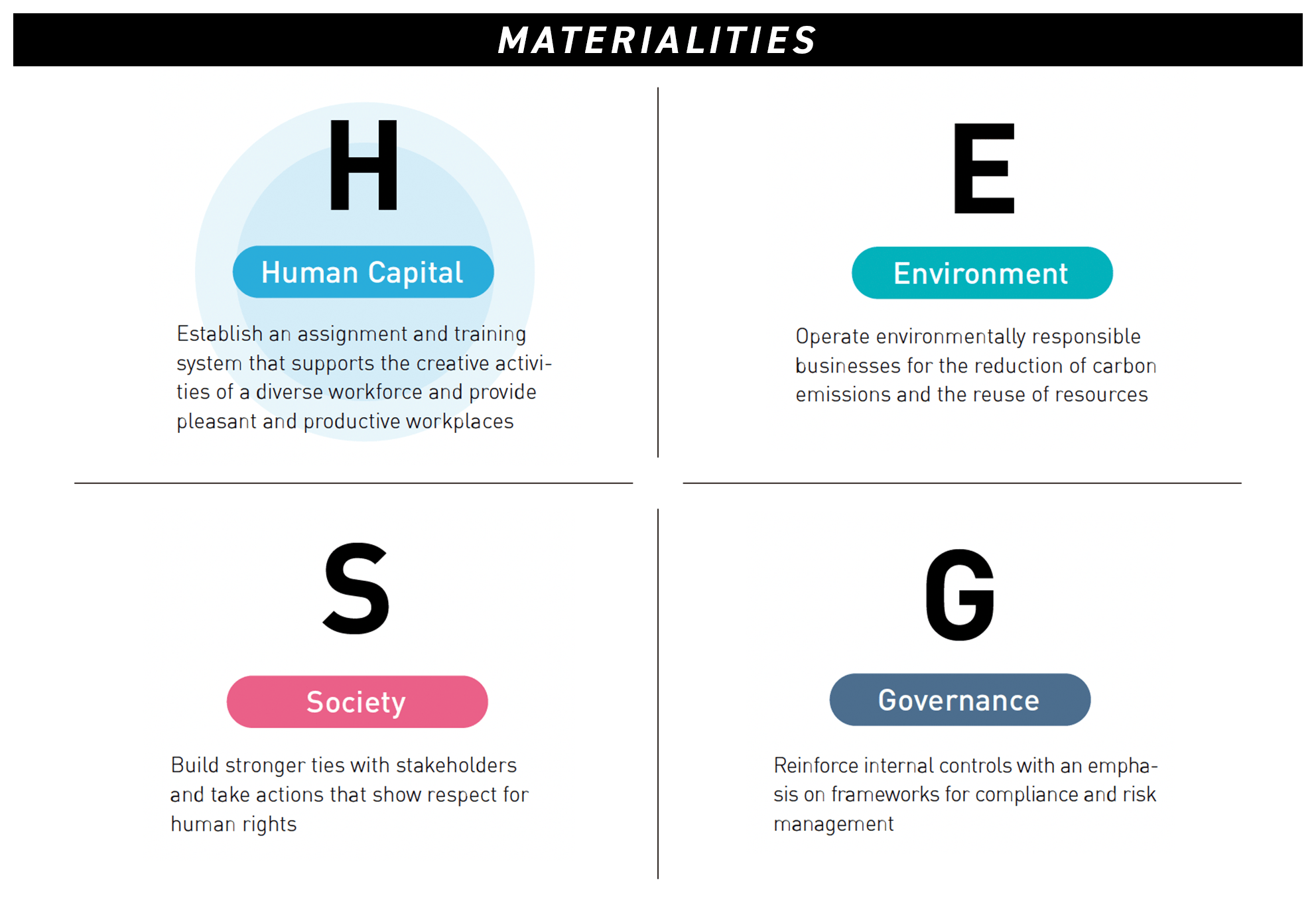

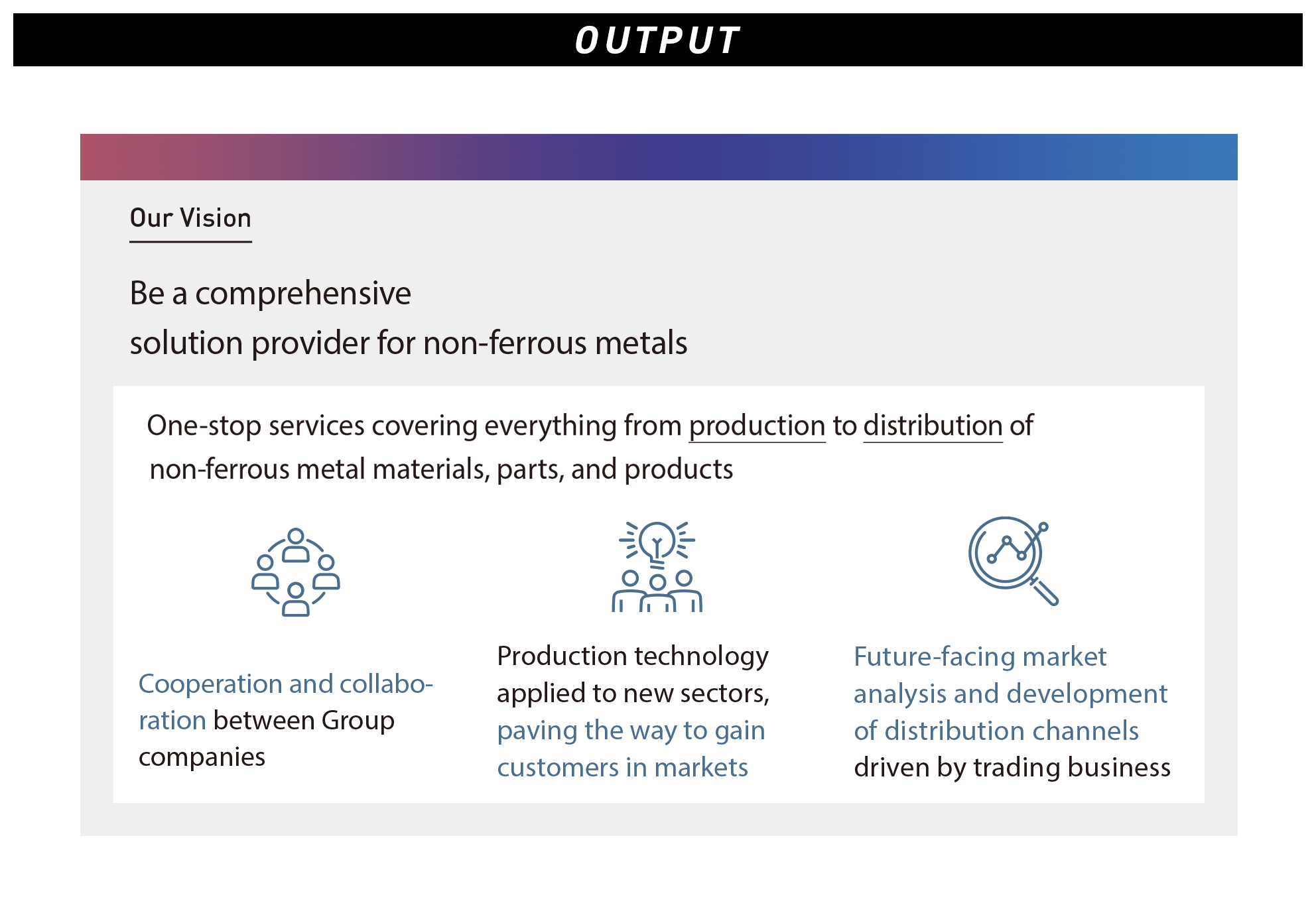

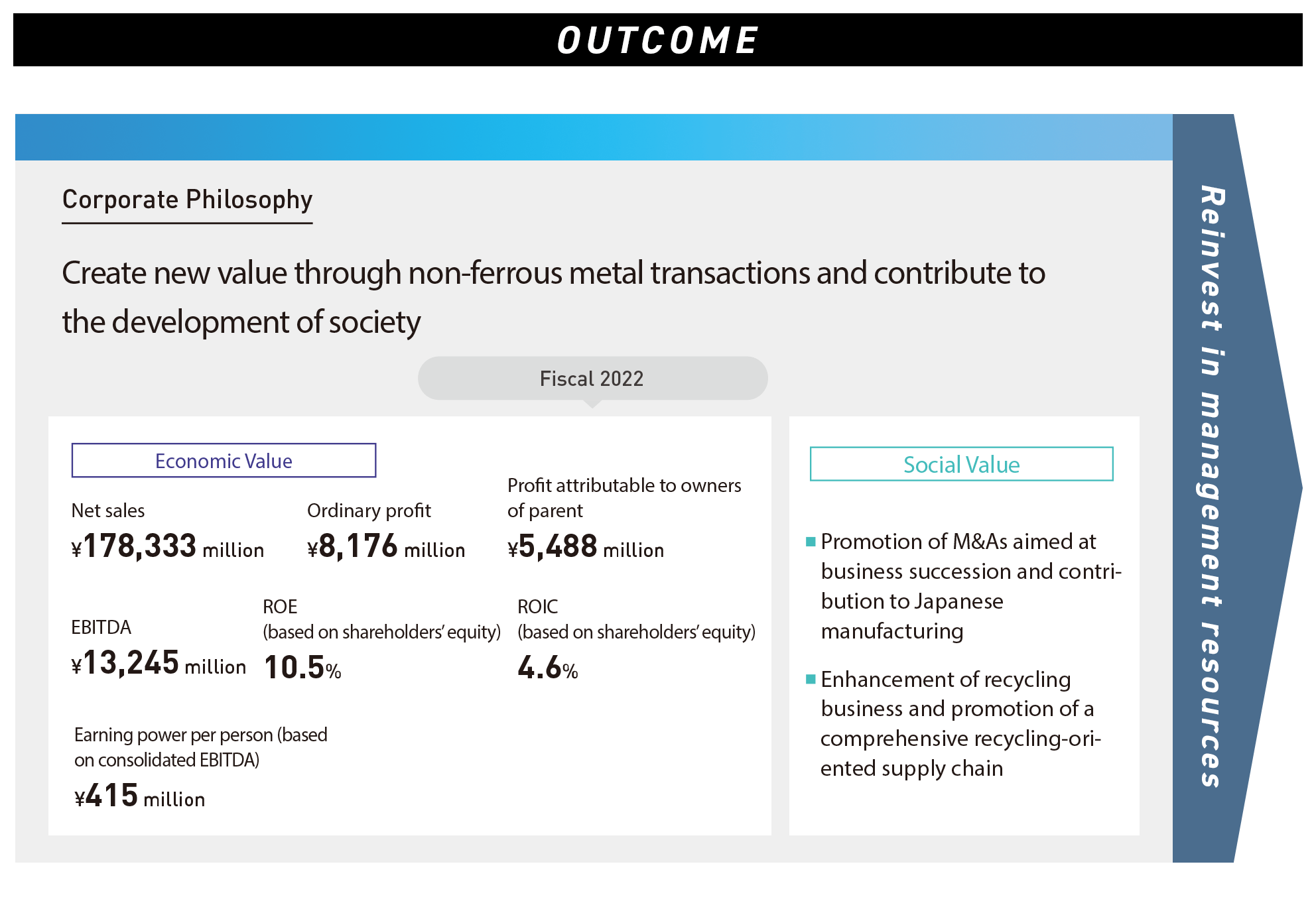

The ALCONIX Group recognizes non-ferrous metals as important resources that support our daily lives and industry and through the trading of these metals, has accordingly sought to create value that will facilitate the development of society at large. During our early years, we achieved steady growth as a trading company specializing in non-ferrous metals through our handling of materials and parts. We have since grown into a fully integrated company by welcoming manufacturing companies into our corporate group and expanding our operational scope well beyond that of a mere trading company. Consequently, we have created a unique business model that rests upon our trading, distribution, and manufacturing capabilities, and by combining these diverse proficiencies, we support societal development that we are confident will lead to the future of our dreams. As we aim to fulfill our medium- to long-term vision of becoming a provider of comprehensive solutions for the non-ferrous metals industry, we will raise our corporate value by generating further synergy through our trading, distribution, and manufacturing capabilities; expanding the added value we create through our business activities; and supporting the achievement of a sustainable society.