- TOP

- Investor Relations

- ALCONIX as an investment

ALCONIX as an investment

For Shareholders and Investors

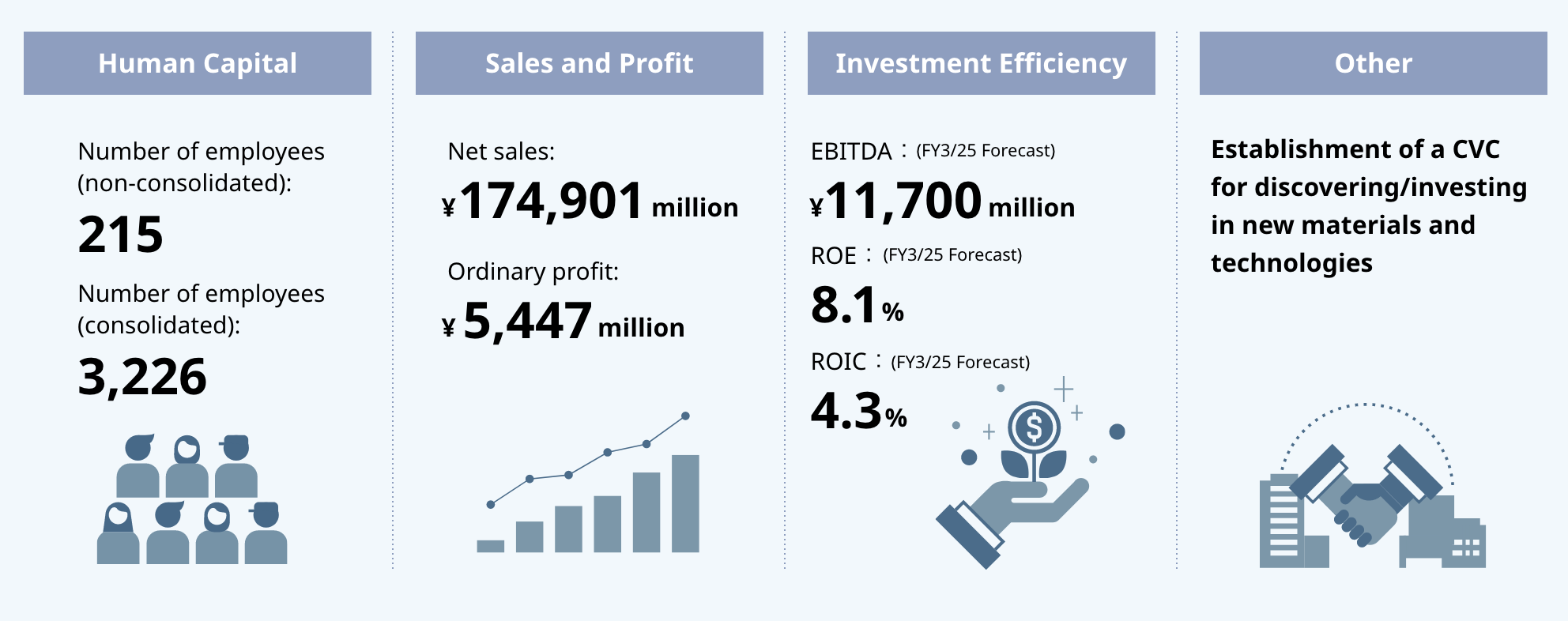

Management Targets

ALCONIX Management Targets(fiscal year 3/31)

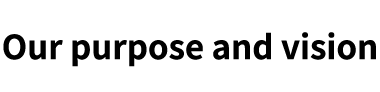

The ALCONIX Group’s Value Creation Process

-

Anticipate Changes

in Social and Market Needs

-

A Mix of Businesses

Combining the Power of Networks with the Power of TechnologyOutput Examples

-

We handle minor metals and rare earths essential for the production of electronic components and materials used in electric and hybrid vehicles, IT-related equipment, and more. -

Handling of copper raw materials and products increasing in demand for semiconductors, automobiles, and other sectors -

We engage in manufacturing that boasts high market shares in niche fields, including cashew particle that is blended into brake friction materials for automobiles and railways. -

We possess nondestructive inspection technology to prevent accidents involving automobiles, railways, airplanes, bridges, power plants, and chemical plants by detecting minute defects without damaging parts or products. -

We handle metal processing parts that are used as core components in the smartphone, tablet, automobile, and aerospace and aviation fields.

-

-

The power of the group allows us to provide

more optimal solutions to more customers.Outcomes

We envision our stakeholders' "Dreamed Future" through transactions centered on non-ferrous metals.

Dividend History

| Dividend Per Share(Yen) | Total Dividend Payment (Full-year) |

Dividend payout ratio |

DOE | |||||

|---|---|---|---|---|---|---|---|---|

| 1st Quarter |

2nd Quarter |

3rd Quarter |

Term-end | Full-year | (Million Yen) | (%) | (%) | |

| FY3/2026 (Forecast) |

- | 42.00 | - | 42.00 | 84.00 | - | - | - |

| FY3/2025 | - | 32.00 | - | 42.00 | 74.00 | 2,251 | 46.5 | 4.0 |

| FY3/2024 | - | 27.00 | - | 28.00 | 55.00 | 1,664 | 103.7 | 3.0 |

| FY3/2023 | - | 26.00 | - | 28.00 | 54.00 | 1,625 | 29.6 | 3.0 |

| FY3/2022 | - | 24.00 | - | 28.00 | 52.00 | 1,450 | 18.4 | 3.1 |

| FY3/2021 | - | 21.00 | - | 21.00 | 42.00 | 1,053 | 37.0 | 2.8 |

| FY3/2020 | - | 21.00 | - | 21.00 | 42.00 | 1,068 | 29.3 | 2.9 |

Please note the following:

- This site will not be immediately updated if correction of earnings data and others are announced.

- Frequency of updates may vary due to changes in earnings report format.

The data used within this site is compiled from the earnings announcements.

In the preparation of the various data shown within this site, we make every effort to ensure its accuracy. But despite our best efforts, the possibility for inaccuracy in the data due to reasons beyond our control exists.

For more detailed earnings information please see the Reference Material.

FAQ

Q1Where can I find the latest financial results information?

Please refer to the IR Library page for financial results details.

Q2When is the date of determining shareholders for payment of dividends?

The date for the year-end profit dividend is March 31. The date for the interim dividend is September 30.

Q3Where is the contact point for stock administration?

Please contact the securities company or Sumitomo Mitsui Trust Bank, Limited depending on the type of stock administration.

| Shareholder administrative procedures |

Procedures

|

Payment of unpaid dividends |

|---|---|---|

| If you have an account | Securities company where you opened the account | Sumitomo Mitsui Trust Bank, Limited |

| If the stock is in a special account | Sumitomo Mitsui Trust Bank, Limited | Sumitomo Mitsui Trust Bank, Limited |

Inquiries to Sumitomo Mitsui Trust Bank, Limited

0120-782-031 (weekdays 9:00-17:00)

Q4 What is the business and organization of ALCONIX?

ALCONIX offers one-stop provision from production through wholesale of nonferrous metal materials, components and products.

The company currently has two segments and four businesses. The Trading segment, our founding business comprises the Electronic and Advanced Materials business and the Aluminum and Copper Products business. The Manufacturing segment, which comprises manufacturing subsidiaries added to the company group through M&A, consists of the Equipment and Materials business and the Metal Processing business. ALCONIX's strength lies in its business mix that combines commercial distribution and manufacturing capabilities.

If you have any questions that are not answered on the Frequently Asked Questions page,

please contact us from below.