- TOP

- Investor Relations

- Long-term Management Plan

Long-term Management Plan

Long-term Management Plan 2030

On May 15, 2025, while carrying forward the objectives, policies, and strategies outlined in the Medium-Term Management Plan 2024, the ALCONIX Group formulated its Long-Term Management Plan 2030, covering a six-year period ending March 31, 2030.

Q1What was the reason behind formulating the Purpose, Vision, and Long-Term Management Plan 2030?

Our Purpose, Vision, and Long-Term Management Plan 2030 provide a clear direction for the entire Group to achieve sustainable growth in an era of volatility, uncertainty, complexity, and ambiguity (VUCA). Each was formulated to serve as a compass for improving value from a long-term perspective.

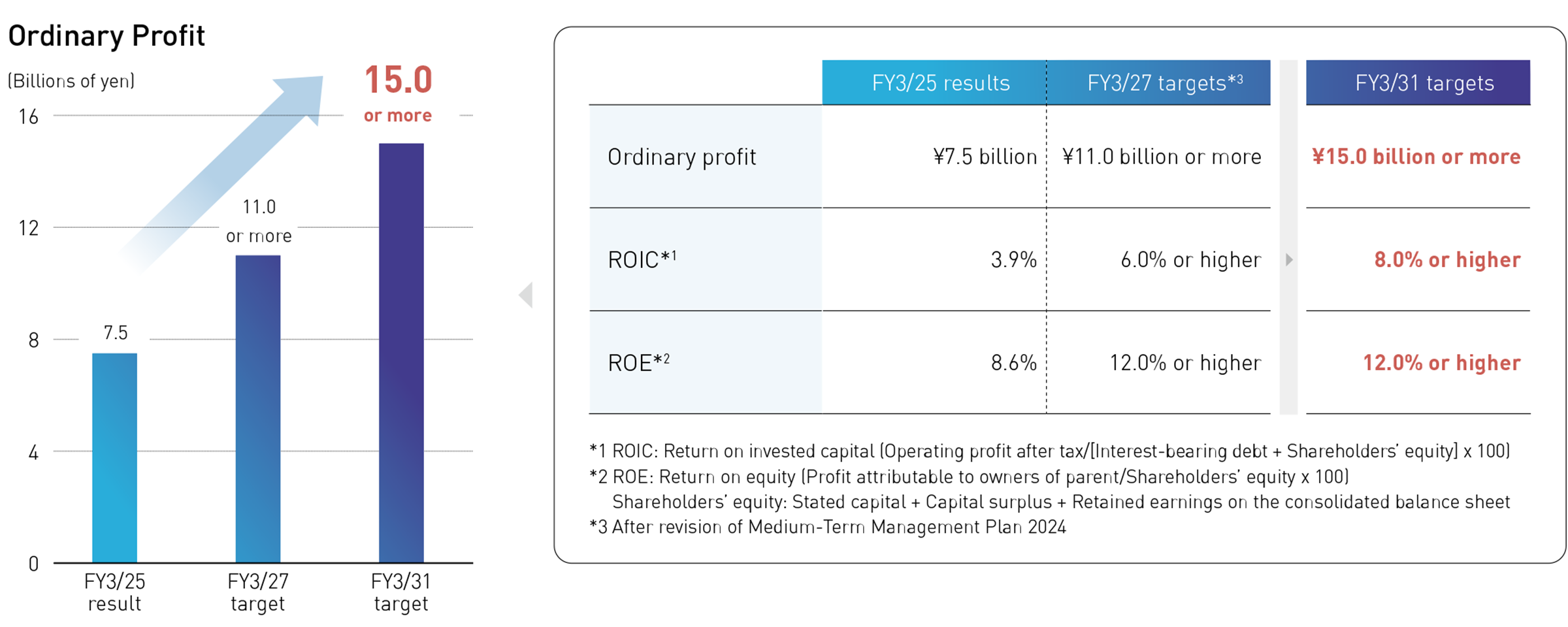

Basic Policies

Group Management Aimed at Sustainable Growth

- Strengthen the Group’s earnings stability and growth potential to chart a new growth curve

- Achieve both the realization of the Purpose and Vision and management with awareness of capital cost and stock price, to create a virtuous cycle of products, capital, and people

- Enhance the management foundation that supports the Group's sustainable business growth and contribute to solving social issues through our business activities

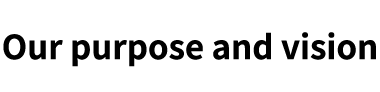

Final-Year Targets for the Long-Term Management Plan

Numerical targets: Achieve the revised targets of Medium-Term Management Plan 2024 (ordinary profit of¥11 billion and ROIC of 6% in FY3/27) and beyond

【Reference】